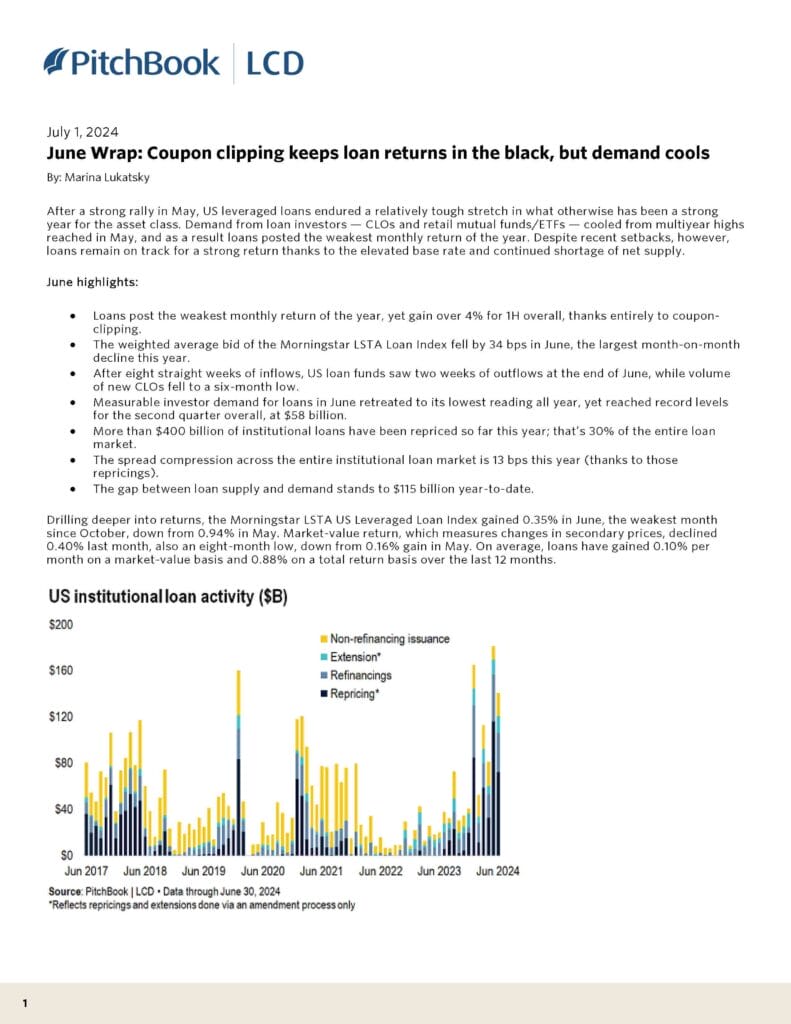

After a strong rally in May, US leveraged loans endured a relatively tough stretch in what otherwise has been a strong year for the asset class. Demand from loan investors — CLOs and retail mutual funds/ETFs — cooled from multiyear highs reached in May, and as a result, loans posted the weakest monthly return of the year. Despite recent setbacks, however, loans remain on track for a strong return thanks to the elevated base rate and continued shortage of net supply. Marina Lukatsky of Pitchbook LCD wrote this.

| File | June-2024-US-Leveraged-Loan-Index-Monthly-Wrap.pdf |

|---|