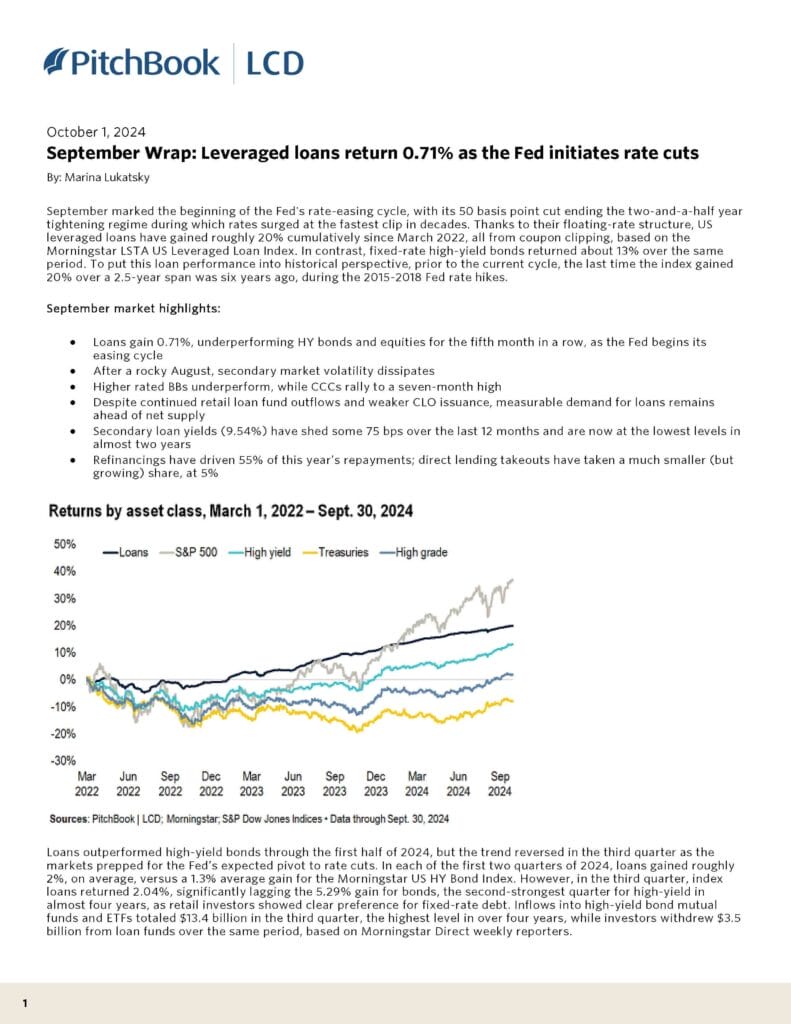

September marked the beginning of the Fed’s rate-easing cycle, with its 50 basis point cut ending the two-and-a-half-year tightening regime during which rates surged at the fastest clip in decades. Thanks to their floating-rate structure, US leveraged loans have gained roughly 20% cumulatively since March 2022, all from coupon clipping, based on the Morningstar LSTA US Leveraged Loan Index. In contrast, fixed-rate high-yield bonds returned about 13% over the same period. To put this loan performance into historical perspective, before the current cycle, the last time the index gained 20% over a 2.5-year span was six years ago, during the 2015-2018 Fed rate hikes. Marina Lukatsky of Pitchbook LCD wrote this.

| File | September-2024-US-Leveraged-Loan-Index-Monthly-Wrap.pdf |

|---|