August 2, 2017 - A recent article by the author of “Fiasco: Blood in the Water on Wall Street” argued that CLOs are the new CDOs. To put it mildly, this is not accurate. Below, we respond to a number of statements in the article.

First, the article suggests that solid CLO issuance this year indicates something nefarious. In fact, CLO formation is strong because CLO performance has been extraordinary. Consider the historical default and loss statistics.

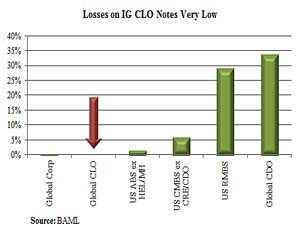

- The long-term loss rate (including the financial crisis) on investment grade CDO notes was 34%. On CLOs, it was just 0.1%. (Moody’s Investors Service)

- There has never been a default on a CLO note rated AA or better. (Moody’s Investors Service)

And while CLOs performed extraordinarily well relative to other asset backed securities, they even have been safer than corporate bonds. Wells Fargo research (2015) compared the cumulative default rate on CLO notes from 1994-2013 to historical 10-year cumulative default rates on equivalently-rated corporate bonds. The results:

- AAA-rated CLO note default rate – 0%; AAA-rated corporate bond default rate – 0.87%

- AA-rated CLO note default rate – 0%; AA-rated corporate bond default rate – 1.13%

- A-rated CLO note default rate – 0.45%; A-rated corporate bond default rate – 2.07%

- BBB-rated CLO note default rate – 0.47%; BBB-rated corporate bond default rate – 5.06%

- BB-rated CLO note default rate – 2.26%; BB-rated corporate bond default rate – 15.96%

The facts clearly show that the ratings were accurate and that CLOs work. These facts cannot be glossed over. But is this just a historical fluke? The article suggests that all the loans underlying the CLO might all default at the same time. Yet, this is highly unlikely. CLOs are required to invest in loans to a diverse set of industries, so that the default correlation would, in fact, be low.

So what level of defaults would be necessary to impair senior CLO notes? Research from Bank of America shows that, assuming historical recovery rates on corporate loans hold, there is no default rate high enough to force losses on the AAA-rated CLO notes. Default rates would have to be nearly seven times the level seen in the financial crisis to force losses on AA-rated CLO notes. Seven times the default rate seen in the worst financial crisis since the Great Depression. Now that is a high standard.

But beyond the clear evidence that CLOs have performed well – and are likely to continue performing well – the suggestion that somehow the companies that CLOs lend to are unworthy because they are not investment grade seems troubling. After all, 70% of rated American companies are rated below BBB/Baa3; these are important and iconic American companies such as Burger King, Avis, American Airlines and Dell, as well as many innovative middle market companies.

The reality is that CLOs provide more than $450 billion of financing to more than 1,000 companies. This has allowed companies to grow and flourish, build factories and pursue acquisitions to expand further. This is something to laud, not criticize.