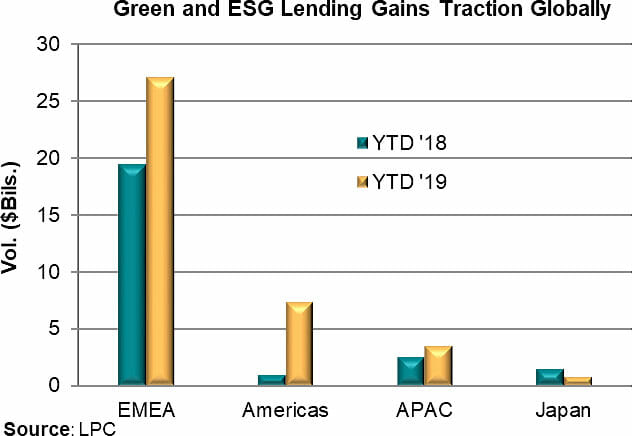

July 2, 2019 - The first half of 2019 has seen global sustainable finance continue to flourish. Refinitiv LPC has recorded nearly $39 billion of global green and sustainability linked loan (SLL) volume through May – a 60% increase over the same time last year. In Refinitiv LPC’s “Loanly Planet” publication that volume is broken down regionally. EMEA continues to be the regional leader in terms of issuance with 70% of the global volume, or $27 billion. However, the biggest increase in regional volume has been in the Americas. With more than $7.3 billion in green loan and SLL volume through May 2019 on the books, that seven-fold increase is evidence that sustainable finance is gaining traction on this side of the pond.

addition to increased activity this year, these loans are being done in new sectors. Where the Energy sector has dominated – and continues to hold strong at 29% of global volume – property development has seen strong activity as well as insurance and specialty chemicals to a much lesser degree, as reported by Refinitiv LPC. In the US, Xylem, a global water technology company, closed an $800 million revolver in March – the first SLL in the General Industrial sector. More recently, Mercon closed a $450 million SLL – the first such facility in the US for a commodity trader and the first coffee-only facility globally. Interestingly, although unsurprisingly, green loans (click here for more information) have accounted for very few of the deals that have closed with 93% of the global volume this year being SLLs, as reported by Refinitiv LPC. Because a green loan’s proceeds must be used to finance or refinance one or more “green projects”, green loans can only address one segment of the loan market. By contrast, SLLs do not have a use of proceeds determinant. Many are used for general corporate purposes and therefore the structure is applicable to a broader swath of the corporate loan market. Moreover, SLLs can also be used as a financing tool in a number of industries. Recognizing the potential of SLLs, the global loan trade associations were quick to publish the Sustainability Linked Loan Principles (SLLP) in March of this year. The LSTA, together with the Loan Market Association (LMA) and Asia Pacific Loan Market Association (APLMA) published this voluntary, high-level framework to enable market participants to clearly identify and understand the key characteristics of SLLs, based around four components which are designed to facilitate transparency and disclosure. (Click here for more information.)

The SLLP categorize loans which incentivize the borrower, typically through margin, to meet ambitious, predetermined sustainability performance targets. In this way, SLLs represent one of the most direct ways of incentivizing a borrower to improve its sustainability profile. Through the setting of meaningful performance targets, lenders can make a real impact in motivating companies—whether those borrowers are already industry leaders in sustainability or just beginning to work toward those goals. The hope is that by creating a recognizable standard the SLLP will facilitate the growth of SLLs. It is too early to say whether the SLLP have yet played a part, but the increasing volume of these loans is certainly good to see. The LSTA will continue to monitor (and engage in) developments in sustainable finance and educate our membership on them.