September 15, 2020 - Anyone following the SOFR debate knows two things about LIBOR fallbacks: 1) All cash asset classes really(!) want a forward looking term SOFR rate and 2) A spread adjustment is needed to reduce the economic differential between LIBOR (a credit risky rate) and SOFR (a risk free rate). This month, the ARRC has taken steps toward making both these dreams come true. We discuss below.

Forward Looking Term SOFR: In its 2020 Objectives, the ARRC announced that it planned to issue an RFP for a forward looking term SOFR rate with the goal of publishing the rate in the first half of 2021 if liquidity in the SOFR derivatives markets had developed sufficiently. This would be highly desirable in cash markets because it means that products like loans, FRNs and securitizations could all fall back from LIBOR to forward looking term SOFR at LIBOR cessation. Because forward looking term SOFR is known in advance of the interest period, term SOFR operationalizes much like LIBOR and would reduce operational risk at LIBOR cessation. It would also eliminate the already-tiny basis between simple SOFR assets and compounded SOFR liabilities in CLOs.

Last week, the ARRC issued its Forward Looking Term SOFR RFP. The term rates should definitely include 1-month and 3-month SOFR, and may include 6 month and 1 year if feasible. The RFP asks 50-odd questions in the categories of technical criteria, firm criteria, public policy criteria and calculation methodology criteria. Notably a number of questions apply to robustness of underlying data and processes, and ensuring the rate can be produced consistently in any economic environment. In addition, as noted in previous posts, any ARRC recommended term rate would need to be compliant with IOSCO Principles and play nicely with the EU and UK Benchmark Regulations. The bar is set high, but the market really wants this rate, at the very least for fallbacks. Responses are due October 31, 2020.

Spread Adjustments: While Term SOFR is on everyone’s fallback wish list, spread adjustments are on the “must-have” list. Static spread adjustments are meant to reduce the economic difference between LIBOR and SOFR for contracts that fall back from LIBOR. Unlike term SOFR, the spread adjustment route is completely clear. As the ARRC’s RFP for Spread Adjustments demonstrate, it’s just a matter of figuring out the nuts and bolts.

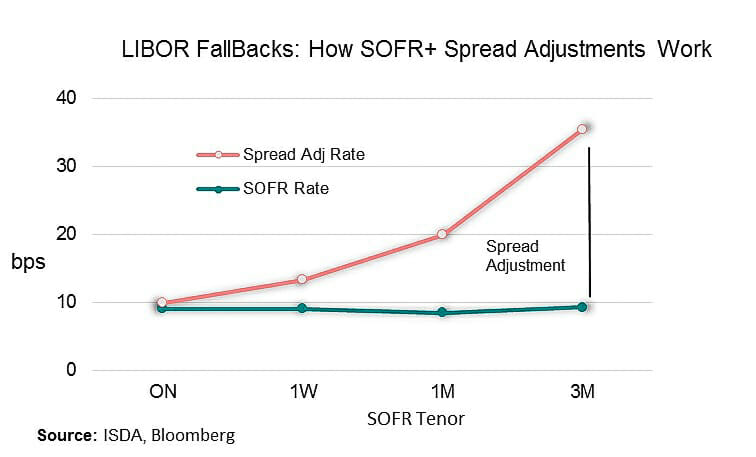

Why is the path forward clear? Because we’re (mostly) following ISDA’s lead. ISDA has already announced that their fallback rate is SOFR Compounded in Arrears and their static spread adjustment for swaps that fall back from LIBOR will be the “five-year historical median” difference between SOFR and LIBOR for each tenor pair (i.e., 1M LIBOR to 1M SOFR, 3M LIBOR to 3M SOFR, etc.) Bloomberg already is publishing the indicative spread adjustment information here. (Scroll down and click the “USD LIBOR Fallback” link and the USD spreadsheet will open. Scroll down to around Row 70 and you will see that as of mid-September the 3M SOFR rate is around 9 bps, 3M SOFR Spread Adjustment is around 26 bps, and the combined 3M Fallback Rate is around 35 bps. This is also shown in the COW.)

Earlier this year, the ARRC announced it will use the ISDA spread adjustment for cash products. Thus, the winning vendor would simply replicate the ISDA spread adjustment for cash products. The tenors include O/N, 1W, 1M, 2M, 3M, 6M and 12M. Importantly, it’s not one-size-fits-all with respect to tenor. SOFR is fairly flat and the LIBOR curve is generally upward sloping. Thus, as the COW demonstrates, the difference between LIBOR and SOFR will also be upward-sloping, creating a different spread adjustment for each tenor.