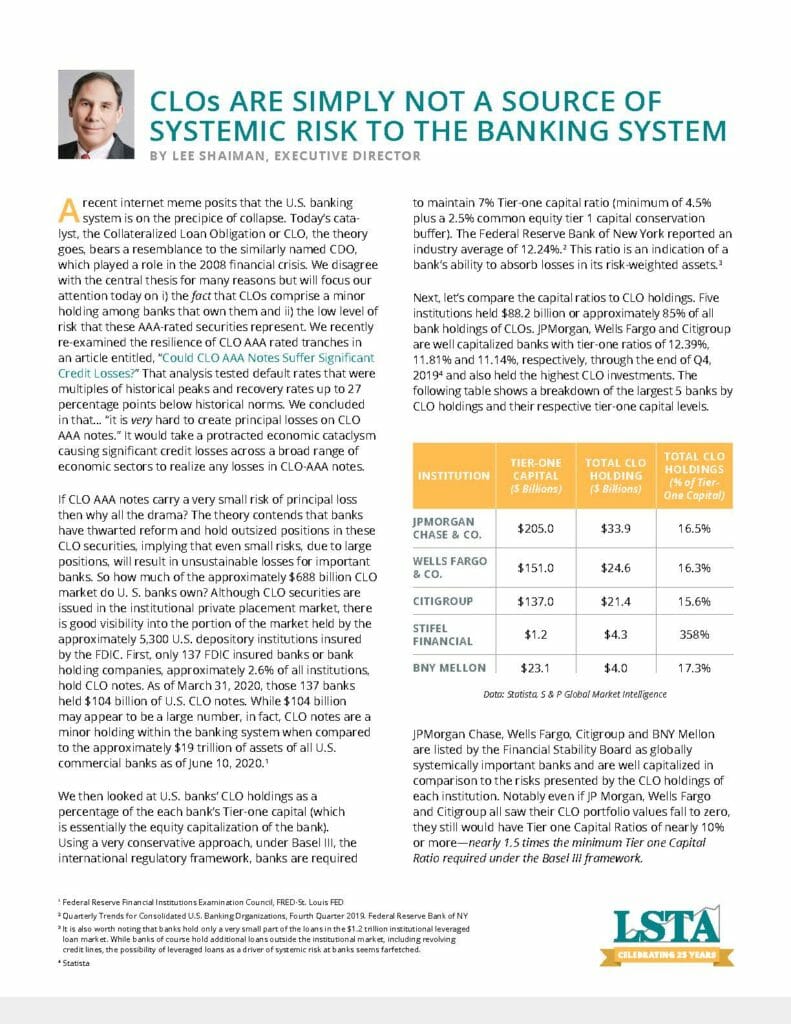

A recent internet meme posits that the U.S. banking system is on the precipice of collapse. Today’s catalyst,the Collateralized Loan Obligation or CLO, the theory goes, bears a resemblance to the similarly named CDO, which played a role in the 2008 financial crisis.

Downloads

| File | CLOs-Are-Simply-Not-a-Source-of-Systemic-Risk-to-the-Banking-System.pdf |

|---|