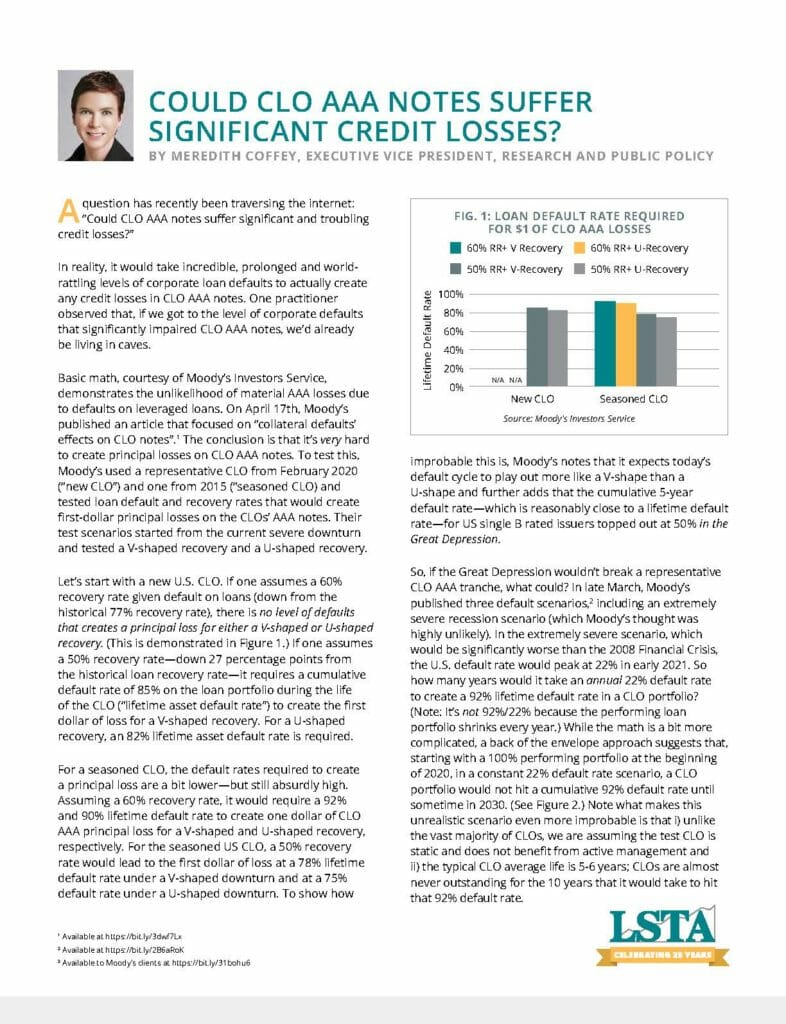

A question has recently been traversing the internet: “Could CLO AAA notes suffer significant and troubling credit losses?” In reality, it would take incredible, prolonged and worldrattling levels of corporate loan defaults to actually create any credit losses in CLO AAA notes. One practitioner observed that, if we got to the level of corporate defaults that significantly impaired CLO AAA notes, we’d already be living in caves.

| File | CLO_AAAlosses_062520.pdf |

|---|