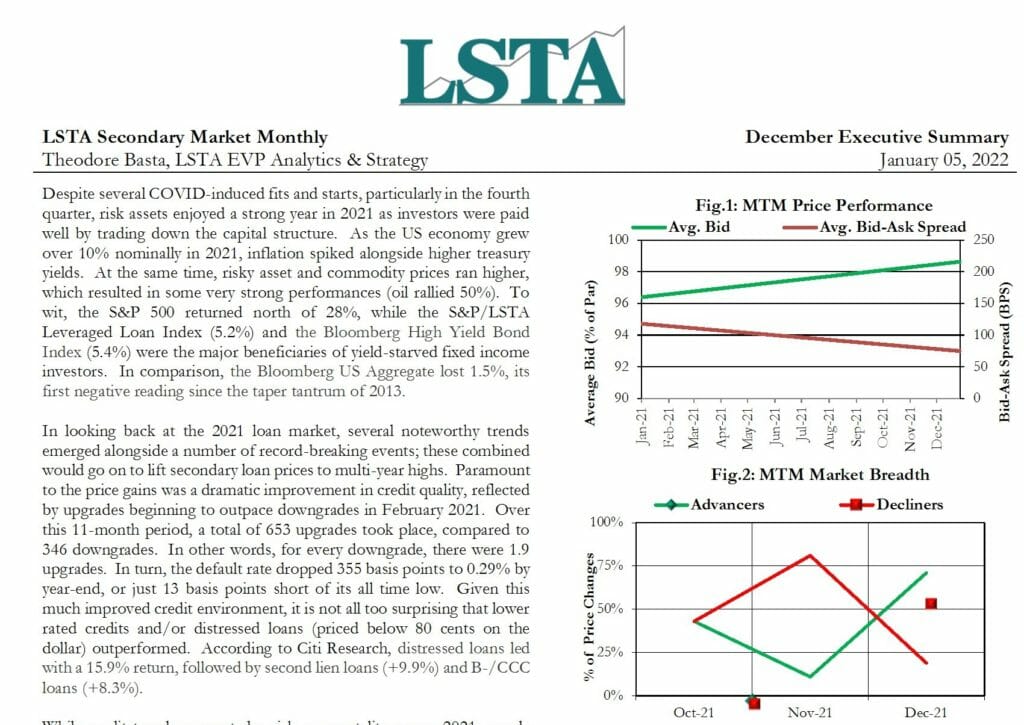

Despite several COVID-induced fits and starts, particularly in the fourth quarter, risk assets enjoyed a strong year in 2021 as investors were paid well by trading down the capital structure. As the US economy grew over 10% nominally in 2021, inflation spiked alongside higher treasury yields.

Downloads

| File | Secondary-Market-Monthly-December-2021-Executive-Summary.pdf |

|---|