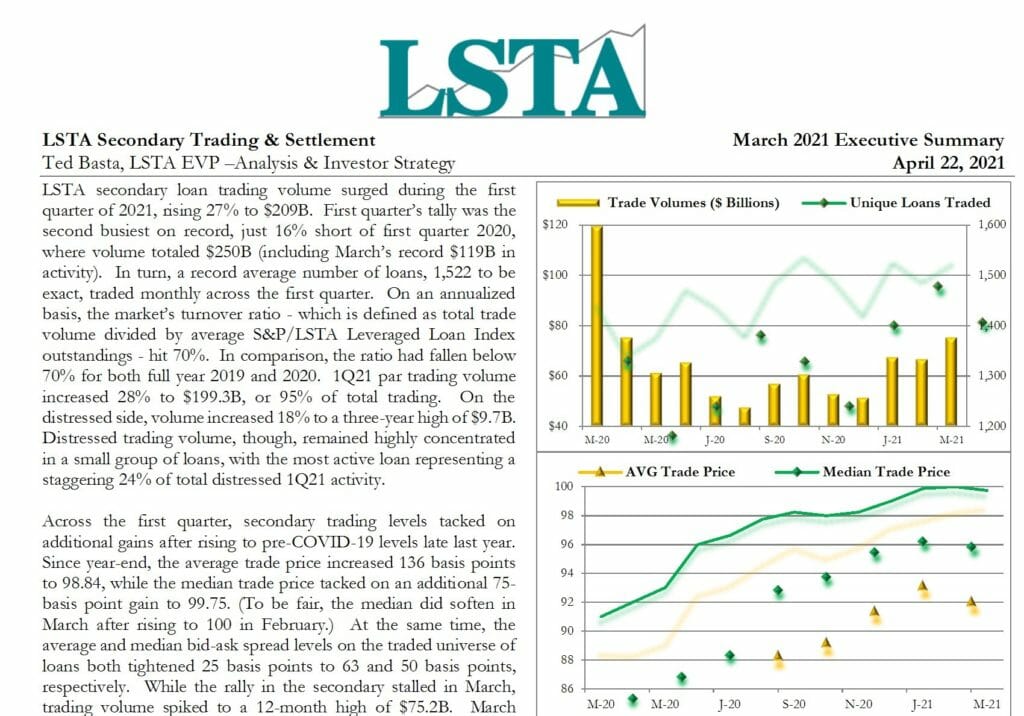

LSTA secondary loan trading volume surged during the first quarter of 2021, rising 27% to $209B. First quarter’s tally was the second busiest on record, just 16% short of first quarter 2020, where volume totaled $250B (including March’s record $119B in activity).

Downloads

| File | Secondary-Trading-Settlement-Monthly-March-2021-Executive-Summary.pdf |

|---|