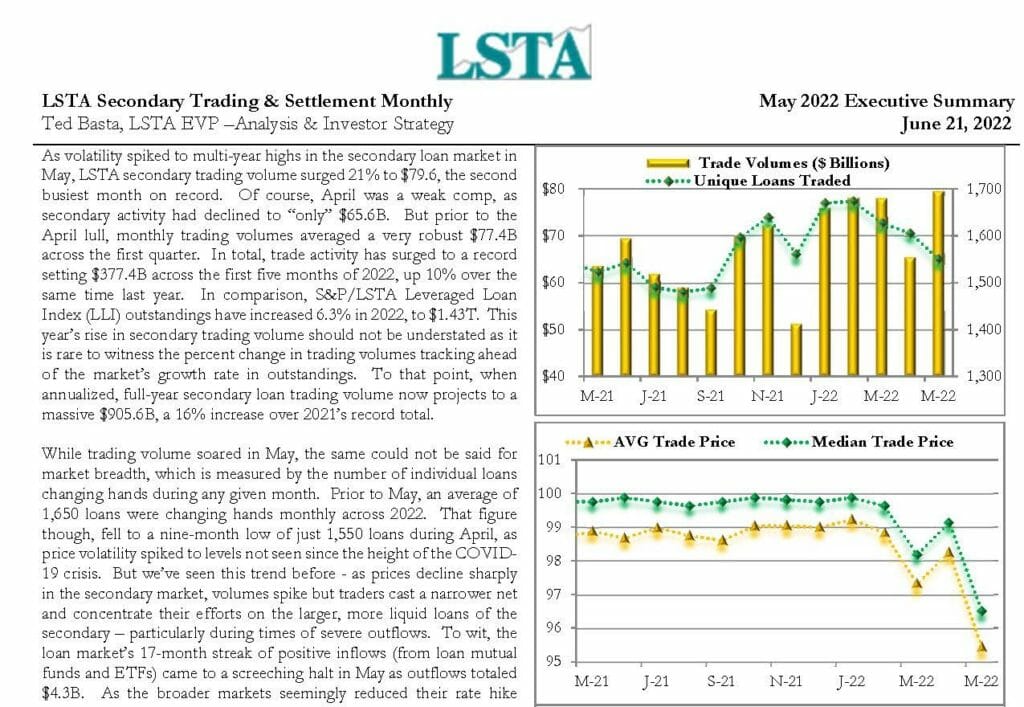

As volatility spiked to multi-year highs in the secondary loan market in May, LSTA secondary trading volume surged 21% to $79.6, the second busiest month on record. Of course, April was a weak comp, as secondary activity had declined to “only” $65.6B.

Downloads

| File | Secondary-Trading-Settlement-Monthly-May-2022-Executive-Summary.pdf |

|---|