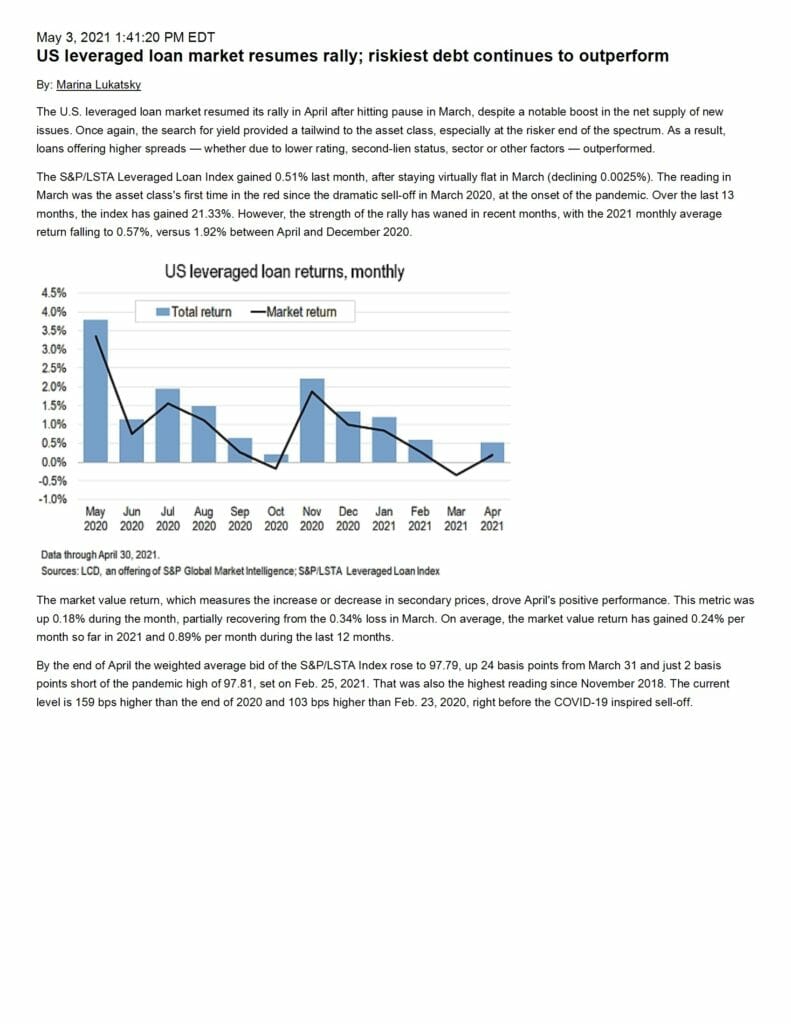

The U.S. leveraged loan market resumed its rally in April after hitting pause in March, despite a notable boost in the net supply of new issues. Once again, the search for yield provided a tailwind to the asset class, especially at the risker end of the spectrum. As a result, loans offering higher spreads — whether due to lower rating, second-lien status, sector or other factors — outperformed.

| File | Index-Commentary-April-2021.pdf |

|---|