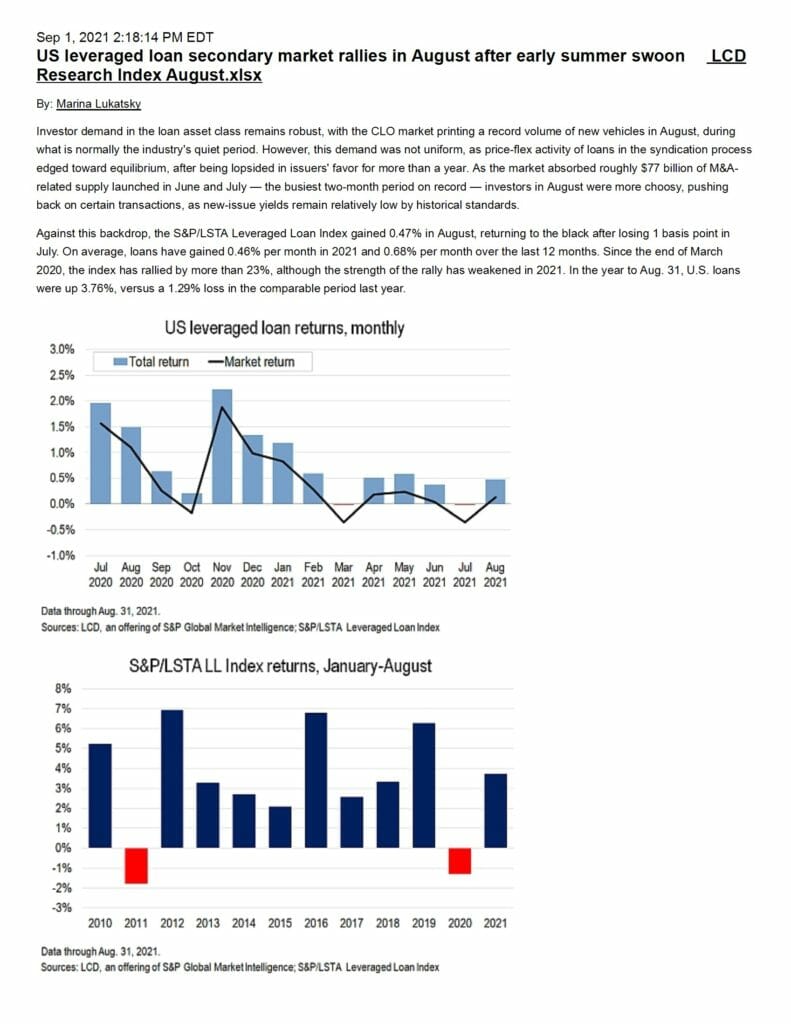

Investor demand in the loan asset class remains robust, with the CLO market printing a record volume of new vehicles in August, during what is normally the industry’s quiet period. However, this demand was not uniform, as price-flex activity of loans in the syndication process edged toward equilibrium, after being lopsided in issuers’ favor for more than a year.

| File | Index-Commentary-August-2021.pdf |

|---|