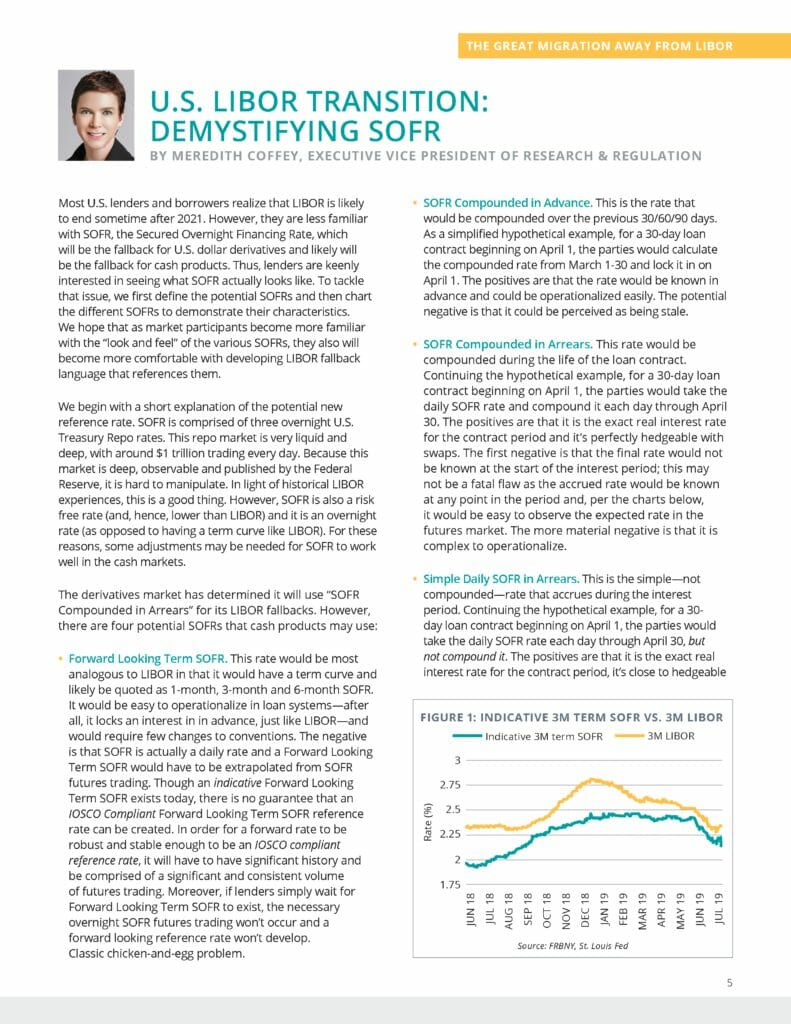

Most U.S. lenders and borrowers realize that LIBOR is likely to end sometime after 2021. However, they are less familiar with SOFR, the Secured Overnight Financing Rate, which will be the fallback for U.S. dollar derivatives and likely will be the fallback for cash products. Thus, lenders are keenly interested in seeing what SOFR actually looks like. To tackle that issue, we first define the potential SOFRs and then chart the different SOFRs to emonstrate their characteristics. We hope that as market participants become more familiar with the “look and feel” of the various SOFRs, they also will become more comfortable with developing LIBOR fallback language that references them.

| File | US-Libor-Transition_Demystifying-SOFR-September-2019.pdf |

|---|