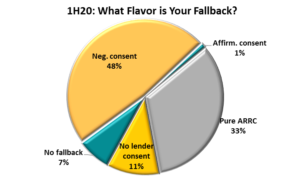

July 16, 2020 - 1H20 was all about “amendment” LIBOR fallbacks in loans. Of the 288 loans that Covenant Review tracked in 1H20, 33% used a “pure” ARRC, fallback and 48% used a (similar) amendment fallback with a 51% negative consent by required lenders. But, starting 4Q20, the pressure will rise to go hardwired: It’s an ARRC Best Practice starting 9/30/20, the ARRC (and LSTA) just released refreshed – and more workable – hardwired loan fallbacks, and banking regulators will start asking about it. Start documenting your new documentation!