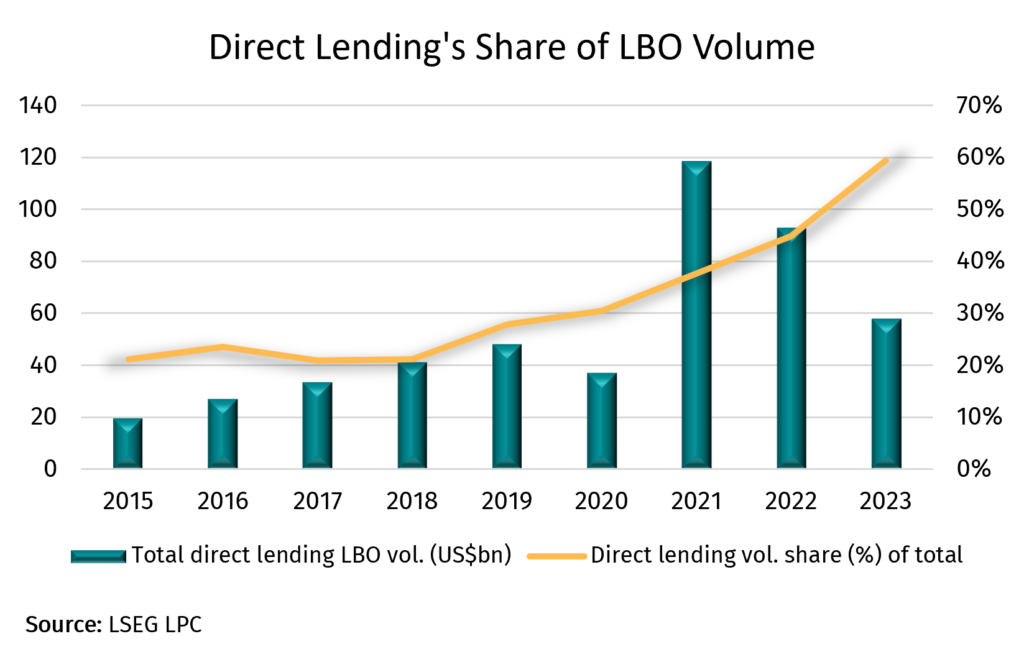

January 31, 2024 - Direct lending has been among the fastest growing segments of leveraged finance, with AUM rivaling that of the broadly syndicated loan (BSL) and high-yield bond markets. As banks became more defensive last year in the face of higher interest rates, BSL activity declined to post-crisis lows. However, direct lending remained active, with lenders supporting portfolio companies and, in some cases, poaching large credits from the BSL market.

While LSEG LPC reported a decline in direct lending activity in 2023, KBRA Direct Lending Deals (DLD) said that volumes actually increased marginally, with the divergence being driven by methodologies that highlight different segments of the markets. That said, both vendors highlighted a very active fourth quarter, with LSEG LPC noting a 31% increase in activity. The spur in activity included large unitranche loans or blended first and second lien facilities favored by larger borrowers. Both KBRA DLD and LSEG LPC registered roughly $35B of large unitranche lending in 4Q23, with LSEG LPC ranking the quarter as the second largest tally dating back to 2014.

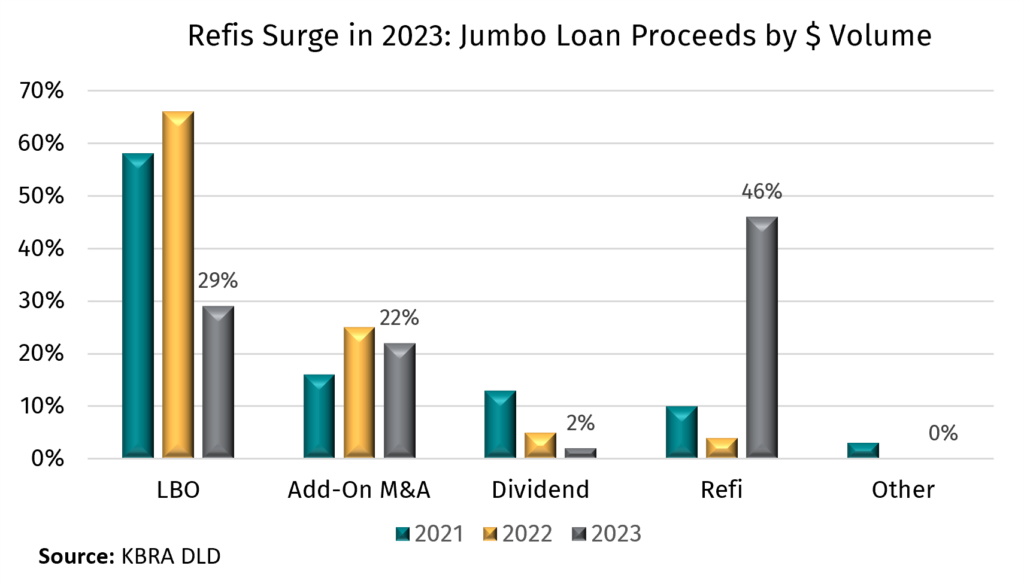

As in the BSL space, 2023 direct lending activity was driven by a surge in refinancings, which made up 26% of volume, compared to just 7% in 2022, per KBRA DLD. Refinancings extended to jumbo loans, which are defined by KBRA DLD as $1B or higher. These deals accounted for about half of all activity last year. Several high-profile borrowers, including Finastra, Hyland Software and PetVet Care Centers grabbed all the headlines, by paying down their BSL “Term Loan Bs” via the direct lending market. In fact, one of the main reasons that the size of the BSL market declined 1.1% was this very reason – companies opting out of the BSL market for private credit.

Looking across to new money proceeds, direct lending LBO activity declined to its lowest levels since the pandemic for most of the year before increasing in 4Q. Overall, direct lending to middle-market LBOs was 41% lower last year, per LSEG LPC, as buyers and sellers remained wide apart on valuations. Accordingly, KBRA DLD’s dataset registered a 24% decline in direct lending to LBOs. Of the buyout activity that took place, private markets were the preferred destination in 2023 as sponsors prized execution certainty. To that point, LSEG LPC observed direct lending to middle-market LBOs was four times larger than BSL in 2023. While LBOs lagged, sponsors focused on existing portfolio companies. According to KBRA DLD, add-on acquisition financing increased to roughly one-third of activity and combined with LBOs, made up 69% of volume last year.

A stronger market tone at the end of the year lifted leverage levels across direct lending deals, with LSEG LPC reporting that total leverage for direct-lending middle-market LBOs increased slightly to 4.3x in 4Q23. That said, leverage levels actually declined to 4.22x across full year 2023, from 4.8x in 2022. For the deals tracked by KBRA DLD, total leverage followed a similar trend, up to 4.3x in December from 4.1x a year earlier. From a pricing perspective, spreads moved wider for most of the year before tightening during the fourth quarter. According to KBRA DLD, first-lien tranche spreads on non-unitranche loans ended the year 39 basis points tighter, at SOFR+584, while unitranches declined the most (55 basis points) to SOFR+588. LSEG LPC observed a similar trend, with middle-market term loan spreads tightening 30 basis points, to SOFR+544. However, factoring in higher base rates and original issue discounts (OID), yields widened to 12% (from 11% a year earlier). Although yields declined for the first time in December, they remain at historically high levels following the Fed’s interest rate increases.

The new year and the rally across markets has shifted back to banks some of the lending activity led last year by direct lenders, with instances of borrowers trading their (more expensive) private credit loans for syndicated TLBs, highlighting the symbiotic relationship between the two markets.