October 13, 2022 - How prepared is the business loan market for the end of LIBOR? That’s the question the Alternative Reference Rate Committee (“ARRC”) sought to answer in its recent Loan Remediation Survey. Our bottom line from the survey results: There is encouraging news – nearly all lenders have inventoried their LIBOR loans and have a remediation plan. But there is less reassuring news too. First, what people intend to do might conflict with market realities. For instance, many borrowers plan to refinance their loans directly into an Alternative Reference Rate (“ARR”) through regular-way refinancing. But with many loans trading in the low 90s, this is clearly uneconomic currently. Second, just 43% of lenders say they will have transitioned the majority of their loans by March 30, 2023; 43% say that will occur by LIBOR cessation on June 30, 2023 – and another 14% say most loans will fallback after LIBOR cessation. This raises the potential of a remediation traffic jam in the final months of LIBOR. Below, we drill deeper into the survey results and contrast them to the realities on the ground.

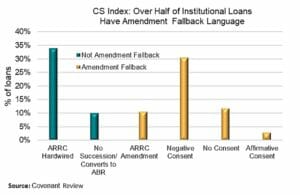

First, what do we see in the market? From LevFin Insights, the CS Loan Index, Refinitiv LPC and CLO trustee reports, we know that about 15% of institutional loans currently are on SOFR; the remainder are on LIBOR. From Covenant Review, we know that 34% of the LIBOR loans in the CS Index have ARRC Hardwired Fallbacks and more than half have a version of an amendment fallback. Thanks to LCD and the Morningstar/LSTA Leveraged Loan Index, we know that in today’s dislocated market repayment rates have plunged to about 1.2% per month this year, down 50% from 2021 levels.

Putting all this together: 1) Borrowers had said that they planned to remediate by refinancing into new SOFR loans in normal course of business. 2) With the leveraged loan markets disrupted – and trading in the low 90s – refinancing rates have dropped by 50% this year. 3) In part because refinancing rates are low, LIBOR transition has lagged, with 85% of loans on LIBOR with less than nine months to go before LIBOR cessation. 3) If loans use fallback language to transition, most will need to use “amendment” fallbacks – and thus will need to go through an amendment process.

How does this compare to the ARRC Survey results? The good news: Nearly 90% of respondents had written remediation plans. For agents and bilateral lenders, 94% had identified all LIBOR loan exposures and 75% had 1) prioritized these by importance of remediation, 2) contacted their borrowers and 3) begun to actively transition loans to a replacement rate. However, 46% of the borrowers that had been contacted planned to refinance directly into an ARR before LIBOR cessation. Reality check: With the leveraged loan markets dislocated, secondary loan prices in the low-90s and refinancing rates plunging, the plan to “organically” refinance most loans into an ARR may be unrealistic.

How quickly will the market be remediated? About 16% of agents said they will have transitioned the majority of their loans to an ARR by YE 2022, 27% said by the end of 1Q23, 43% said by the end of 2Q23 (when LIBOR ceases) and 14% said after LIBOR cessation. This suggests that there could be a traffic jam as nearly 60% of loans enter the remediation queue just months before LIBOR ends.

While these numbers may be concerning, 45% of respondents did say that “none or very few” “amendment approach” loans would fallback after LIBOR cessation. In other words, it will be the “hardwired” loans that transition after LIBOR cessation. But do the numbers support that? As the COW demonstrates, over half of the LIBOR loans in the CS Index have amendment fallback language. If agents aggressively prioritize early remediation of amendment fallbacks, perhaps there won’t be too many transition amendments around LIBOR cessation. But if not, watch out for that traffic jam.

How do things look from the non-agent POV? 85% of bank/non-bank lenders have identified all their LIBOR exposures and 43% have been contacted by agent banks on LIBOR transition plans. However, 40% have received no/few LIBOR fallback amendments to date.

On the borrower side, there is good news and bad news. First, 90% of borrowers have been contacted by their lender regarding LIBOR transition. However, 55% said that they intend to refinance directly into an ARR prior to LIBOR cessation. Again, this conflicts with the low refi rate we have seen in 2022’s dislocated market. If markets do not improve, we would expect more borrowers to join the 45% that plan to amend into SOFR using early opt-in fallback language.

Our final takeaway: Gear up for amendment fallbacks, get working on that backlog – and avoid that traffic jam!