March 24, 2022 - This 1984 catchphrase was made famous by actress and Wendy’s spokesperson Clara Peller. The same might be asked of SEC’s Private Funds Disclosure Rule (“proposed rule”) as it relates to CLOs. To be fair, it is not clear that the proposed rule specifically and intentionally targets CLOs, but we really don’t believe there’s any beef here either. To that end, today we tackle CLO performance. In coming weeks, we’ll weigh the merits of other issues in the proposed rule, including quarterly reports and annual audit requirements.

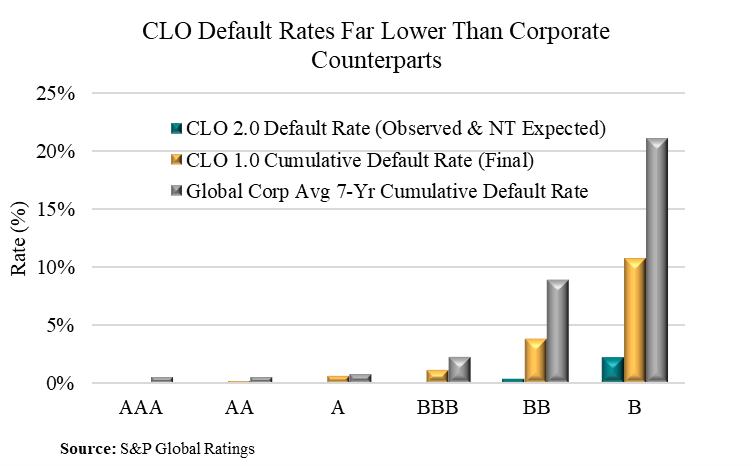

CLOs have undergone several trials by fire – first in the global financial crisis and, more recently, in the Covid-19 Pandemic – and they’ve performed remarkably well. This is underlined by their default statistics. This week, S&P reviewed US CLO defaults as of March 17, 2022. Since the mid-90s, S&P has rated more than 16,000 CLO tranches, totaling around $1.2 trillion. So, it’s not exactly a small dataset. The agency broke its data into two components: i) 1.0 CLOs, which were issued from the mid-1990s to 2009, and ii) 2.0 CLOs, which were issued from 2010 onwards. The 1.0 vintage has been fully paid down now, so their default statistics are final. The 2.0 CLOs are still live – and growing – so their default rates likely will be understated. That said, 2.0’s documentation is generally tighter and subordination higher, S&P notes, so they have more safeguards built in.

Here’s the punchline: As the COW demonstrates, all CLO default rates are markedly below that of equivalently rated corporates. At every level of the rated notes, 1.0 CLO default rates – which are final and fixed – are a fraction of corporate default rates. In fact, at their highest, CLO tranche default rates are half that of the equivalently rated corporates. (The stats for 2.0 CLOs are even more impressive, but because they are ongoing, they have more time for defaults potentially to climb.)

Why does this matter? CLOs have performed very well for their investors and are extraordinarily transparent (more on that later). And so, imposing an ill-fitting regime (more on that here) on them may have considerable costs with little benefit for investors.