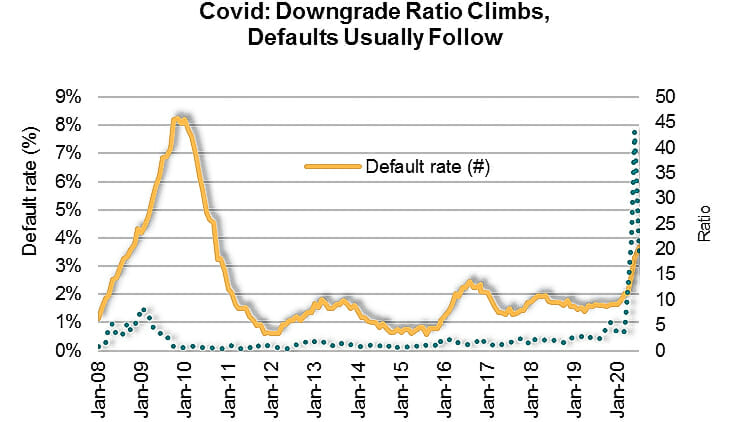

July 31, 2020 - COVID is coming home to roost. Obviously, there have been devastating personal impacts as well as a record 32.9% annualized contraction in GDP. And, of course, COVID-impacted companies appear to be under significant stress. S&P/LCD wrote that their “Weakest Links” – loans rated B- or below and on negative watch – has swelled to 25% of their leveraged loan universe. This is up nearly eight percentage points from the end of March, demonstrating the ferocity of rating agency downgrades after the pandemic hit the U.S. Indeed, as the COW demonstrates, the downgrade/upgrade ratio swelled to 43:1 in May as there were more than 400 downgrades and just a handful of upgrades. As the COW also shows, the downgrade/upgrade ratio typically leads the default rate. The S&P/LSTA Leveraged Loan Default rate sat at 3.7% by volume/3.88% by count on July 20th; Fitch has it pegged at 4.1% on July 29th. Either way, it is climbing.