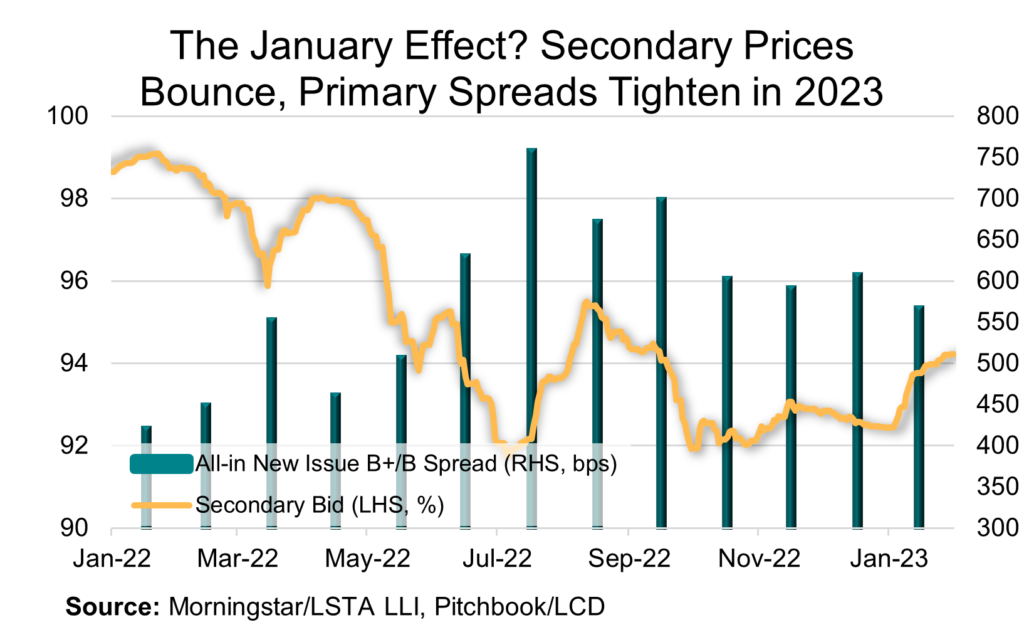

February 2, 2023 - Like a gym member with a New Year’s resolution, the loan market started off strong in January. Thanks both to improving sentiment – case study: Nasdaq’s 2% jump following the Fed’s 25 bps rate rise on Wednesday – and borrower-friendly technicals, January enjoyed a remarkable rally. The secondary market saw the best start of the year since 2009, Pitchbook LCD wrote. First, the average secondary bid in the Morningstar/LSTA Leveraged Loan Index (LLI) jumped 178 bps to 94.23 (see COW). Add this strong secondary price rally to significant loan coupons (thanks partly to 1M LIBOR and SOFR both approaching 4.6%), and the stage was set for a 2.73% return in the LLI in January.

While not setting breaking decade-long records, the primary market enjoyed something of a recovery in spreads (if not in volumes). According to LevFinInsights, January saw 11 reverse flexes to no upward ones. Refinitiv added that January’s average OID came in at 97.43 compared to 96.5 in December. Buoyed by this, the average all-in new issue spread (which includes amortized OID and any CSA) dropped 40 bps from December levels, ending at SOFR+564 (see COW).

Though improvements in sentiment across asset classes no doubt helped, the rebound in loans was mostly driven by technicals. On the loan supply side, net supply – as measured by changes in outstandings in the Morningstar/LSTA LLI – has actually been negative. At $1.4 trillion even(ish), LLLI outstandings are down more than $7 billion in January and nearly $30 billion from their October highs. Measuring supply another way – new issue loans minus any associated repayments – netted LFI a mere $4.6 billion in the month. Either way, loan supply was low.

At the same time in January, visible investor demand has grown. LevFinInsights tracked 15 BSL and two middle market CLOs hitting in January, totaling $7.37 billion. Pitchbook LCD added that this is the third-highest January CLO tally in the post-GFC period. Now, admittedly, measuring current CLO-driven demand is an imperfect science. After all, not all these deals reflected new January demand; a number cleared long-standing warehouses. What these deals do reflect, though, is a tightening of liabilities spreads: As of mid-January, average CLO AAA spreads dipped to SOFR+205, after ending the year in the 240 bps context, Refinitiv charted. Meanwhile, after a brutal 2022, 2023 loan mutual fund flows seemed more benign – at least until the February 2nd reading! While they still trended negative in January, weekly outflows through late January were modest and even spiced with a week of inflows, according to Refinitiv.

Bottom line: 2023 was off to a strong start in January. Now if we can just avoid the gym member’s February fade!