September 30, 2020 - On Tuesday, LSTA EVP Meredith Coffey chaired a panel at the IMN Virtual LIBOR Conference that focused on how to transition the thousands of loans and CLOs that must move from LIBOR to SOFR in the coming 15 months. The LSTA will be drill further into these issues at the LSTA Annual Conference session, LIBOR Transition: What the Business Needs to Know.

The panel addressed a number of hot button issues: First, foundationally, LIBOR cannot be assumed to exist after year-end 2021. Second, the logjam to successful transition in the loan market has been broken! For over a year – 2018 through 2019 – market practitioners tried to jam syndicated loans into the “Compounded in Arrears” template. It’s a very challenging fit. Then in late 2019, we determined that, economically¸ Daily Simple SOFR is nearly identical to Compounded SOFR and operationally Simple SOFR is a much easier lift (See slides 5 &6). Once we determined that, vendors ensured that Simple SOFR was operational in their systems and we revamped loan hardwired fallback language to point to Simple SOFR as the preferred second step in the fallback rate waterfall. Related to that, the ARRC recommends that hardwired fallback language begin to be used by September 30, 2021. And, lo, we have seen hardwired fallbacks begin to emerge – with Simple SOFR as the second step – and expect that trend to accelerate in the fourth quarter.

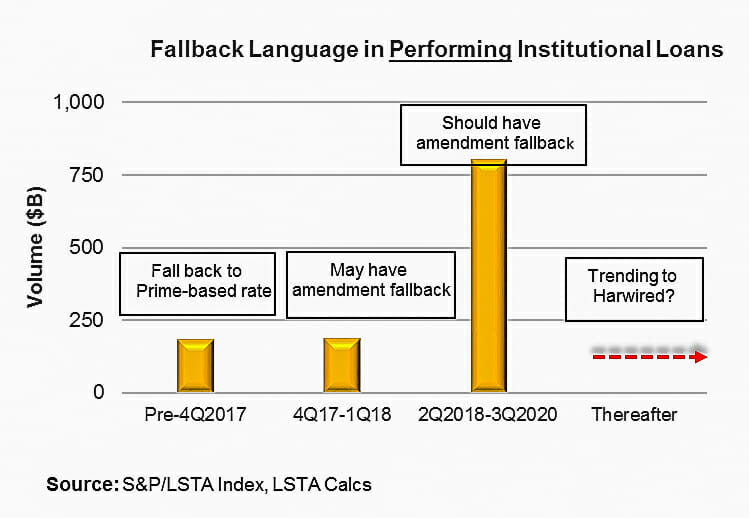

Third, hardwired fallbacks will make LIBOR transition easier – though it still won’t be easy – but there remain thousands of loans and CLOs that will have to fallback through the “amendment” approach. This will be far harder. On slide 9, we took the $1.17 trillion of performing institutional term loans that will need to be transitioned from LIBOR to SOFR and divided them into cohorts based on the likely strength of their fallback language. First, there is about $186 billion of loans originated before 4Q2017. Since we didn’t really know LIBOR was ceasing for loans until around that time, these loans likely have no real fallback language and likely fall back to an expensive Prime-based rate. Starting around 4Q2017 and going into 1Q2018, documents increasingly included “amendment” fallback language that indicated that, once LIBOR ceased, the borrower and agent could identify a replacement rate. However, in these two quarters, the language was fairly non-standard. By 2Q2018, some norms were coalescing and most of the subsequent loans included more standard amendment fallback language that included some variation of: 1) LIBOR ceases, 2) borrower and agent identify a replacement rate, and 3) required lenders have some negative consent rights. That formulation basically stood until recent days when a few hardwired fallbacks have begun to emerge.

On slide 10, we offered a similar analysis for CLOs, estimating that pre-2018 CLOs – $150-odd billion – have no fallback language, and are likely to fall back to “last quoted LIBOR” or a fixed rate. CLOs issued 2018 through 1H2019 likely have highly variable “amendment” fallback language. Starting in 2H2019, more CLOs started using hardwired fallbacks – those responsible know who they are and we thank you – and by 1H2020, most CLOs were hardwired. While hardwired should be the wave of the future, the market still must remediate (and potentially amend) thousands of loans and CLOs. (And we’re not even counting the “rest” of the $4.8 trillion syndicated loan or uncounted bilateral loan market here.) This is not a light lift. But we have a strategy…and we plan to begin sharing it at the LSTA Annual Conference in October.