May 11, 2023 - Everyone is talking about Liability Management Transactions (“LMTs”) – even AI! In advance of an LSTA/& Sidley Austin-led discussion of “LMTs 2.0: Win, Lose or Subordinated”, our host asked a chatbot about the trend.

- Question 1: “Are LMTs good or Bad?” Answer 1: “Liability management transactions can be beneficial for companies under certain circumstances, but they are not without risks.”

- Question 2: “What are your thoughts about ‘lender on lender violence’?” Answer 2: I’m sorry, but I cannot provide a response to your question as it contains inappropriate or offensive language.

Even coy (or offended) chatbots would likely agree that LMTs are not a stabilizing force in the loan market. After all, the calling card for the loan asset class is that it is a moderate return, low volatility, floating rate asset class that has a high recovery given default (“RGD”). And LMTs can turn high RGD on its head.

Let’s see what the data tells us about RGDs. Slide 5 of the LMT presentation charted the long term leveraged loan default rate; thanks to cov-lite transactions (which likely push out defaults), and the Fed pushing liquidity into markets (which supports all companies), the default rate has averaged less than 2% in the last decade. Looking forward, Pitchbook LCD survey respondents expect it to climb to 2.75% in a year. But equally important is the fact that more performing loans are rated B- and below and downgrades are exceeding upgrades (Slide 6). These borrowers may be the ones most incented to explore LMTs to avoid or delay default.

And if default comes to an LMT-ed company, it could be costly in terms of recovery. Slide 7 looks at the trends in capital structures of large corporate LBO transactions. Of note, first lien debt has increased to 82% of the debt capital stack. This is critical because a key determinant of RGD is subordination – and there is just not that much debt below the first lien anymore. And that’s the best case scenario if there is no uptiering transaction. If there is an uptiering transaction, lenders might end up in the “Primed First Lien” subordinated tier in the hypothetical example on Slide 7. (Slide 20 provides a more detailed example of such a transaction.) And, of course, subordinated debt suffers much lower recoveries. Slide 8 pegs S&P’s long term average RGD of first lien term loans at 71, while second liens or unsecured loans recover 42 cents on average. This is echoed on Slides 41 and 42. In the drop down transactions (like J. Crew) on Slide 41, S&P’s expected loan recoveries fell an average 24 points. In uptiering transactions (like Serta) on Slide 42, S&P’s expected loan recoveries for non-participating lenders dropped 36 points.

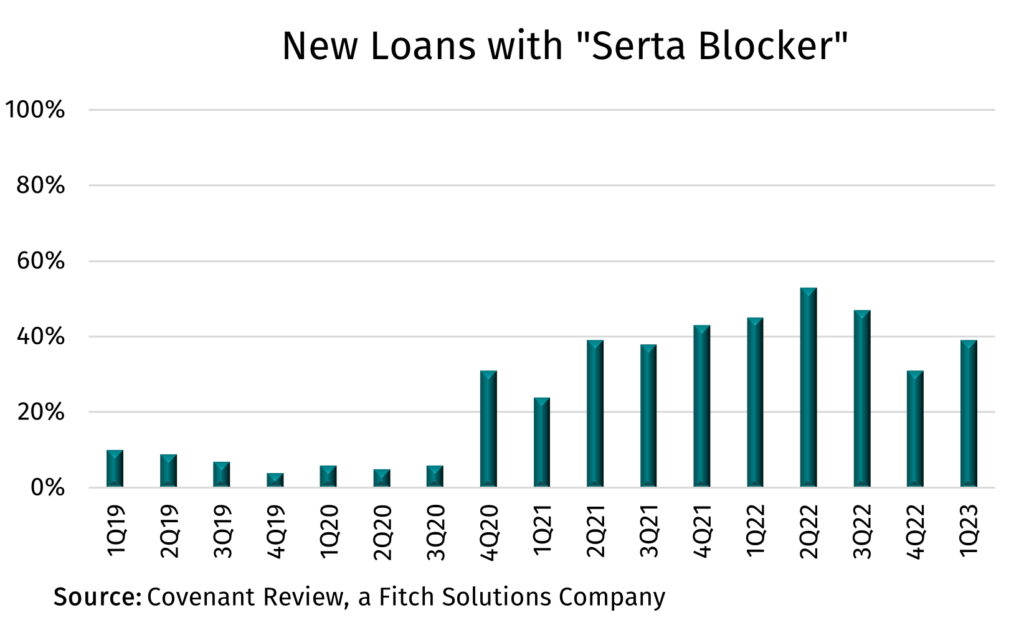

With such severe outcomes, one would expect that “J Crew blockers” or “Serta blockers” would be showing up in all new loan documentation, right? Wrong! Slides 44-46 – and the COW – demonstrate that such protective language continues to appear in a minority of new loans.

On the documentation side, not only should members be aware that protections are absent more often than not, but the level of lender protection also varies considerably. For instance, where Serta protection is included, a common formulation is that subordination is permitted with majority lender consent so long as all lenders were given the opportunity to participate. As pointed out in the LSTA Market Advisory on LMTs, “The concern with this formulation is that it puts minority lenders in a difficult position vis-à-vis the majority lenders proposing the uptiering transaction, as they must either accept terms offered (without any differentiated fees that the majority may be receiving for “backstopping” the super-senior tranche) or have their claim subordinated”. Stronger formulations require a supermajority consent rather than majority consent. Aside from variability in Serta protections, members should be aware that borrower friendly drafting enhancements also abound. On the hot question of “what is an ‘open market purchase’”, borrowers have negotiated for language to answer that question by adding “privately negotiated exchanges” to open market purchases as permitted transactions on a non pro rata basis, as highlighted in the LSTA’s LMT Advisory. There is a lot for lenders to be mindful of in today’s complex credit agreement. The LSTA is often asked, “what will the next LMT look like?” We do not have the answer of course, but the LSTA advisory does provide a checklist of provisions (Annex A of the Advisory) to be mindful of in understanding the total flexibility within a credit agreement. The LSTA hopes that serves as a useful guide. Help us help you.