June 6, 2018 - At the LSTA’s Annual Asia Conference swing this week, the major takeaway was that, while there are undeniable challenges in the long term, things look (fairly) rosy in the near term.

As the presentations illustrate here and here, the trend of near-term comfort and longer-term concern permeated all levels of the conference. Kicking off, the keynote economist counseled temperance in light of the global saber rattling. Geopolitical noise affects markets, but unless it leads to policy change, it seldom drives economic forecasts. While the U.S. GDP growth rate may slow from 3% to around 2%, there’s little on the horizon that suggests an imminent recession. (Caveat: Other than the U.S. Fed raising interest rates longer than they should, which could lead to a recession in 2020 or 2021.)

But wait…While hard to model, tectonic shifts in geopolitics cannot be ignored, said the second keynote. Though it might not dramatically move markets in the short term, we may be seeing a reintroduction of “Great Power Politics”, characterized by a weaponization of capital, trade and investment. While it might not dictate whether a recession comes in 2020 or 2021, this shift may mark one of history’s turning points.

So what do these lofty thoughts mean for the loan market? For the most part, business as usual. As the Headline News segment observed, macroeconomic conditions are very favorable for deal making but high equity valuations are likely to hold new issuance below last year’s levels. The continued presence of Leverage Lending Guidance (in some form) creates a supply deficit in the face of strong demand from CLOs, mutual fund and institutional accounts – and presages continued spread tightening. Though speakers were concerned about degradation of loan documentation and structural protections in the longer term, the strong economy and market technicals remain supportive of a healthy loan market.

But for how long? The Credit Trends panelists described the credit cycle as being in late stages but still sustainable over the next few years. Though leverage has climbed, it’s still in check and interest coverage has trended to all-time highs. Macro concerns revolved around the Fed, while micro concerns were confined to a handful of sectors (media, retail) where technology remains a disruptive force. And while default rates should remain low over the next two years, plan for greater dispersion in future recovery rates due to weaker documentation.

In light of near-term strength but potential longer-term unpredictability, how and where should one invest? On the one hand, the Secondary panelists recommended the liquidity of the BSL market. Loans have performed very well post-crisis, despite the ultralow rate environmental over the past nine years. Annual returns have averaged 5.4%, while interest income averaged 4.8%. Moreover, with interest rates finally climbing (and volatility hitting other markets), loans have outperformed other fixed income markets over the past 6- and 12-month periods. In fact, as interest rates and volatility popped, investors fled the bond markets and put their money to work in the floating rate loan market. Moreover, liquidity continues to improve: LTM loan trading volumes hit a record $650 billion, while bid-ask spreads tightened to a post-crisis low of 48 bps. Indeed, all panelists agreed: Their ability to actively manage risk in the secondary trading market has never been better.

Or…on the other end of the spectrum, Middle Market was touted as an attractive investment avenue. Mid -market and direct lending has grown dramatically since the economic recovery, thanks to superior risk adjusted returns and the reluctance of banks to underwrite (due both to regulatory and capital sufficiency reasons). But while risk-adjusted returns might be strong, liquidity is not. The analogy: Underwriters of BSLs are in the “moving business” while middle market investors are in the “storage business”. So, perhaps it offers superior risk-adjusted returns – if you know what you are doing.

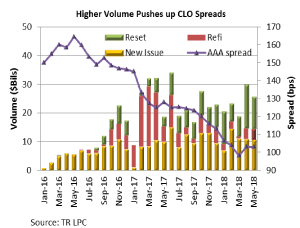

Still, one of Asia’s current favorite investment vehicles does not especially rely on either secondary market liquidity or the middle market. Asian investors are a major buyer base for CLOs, with Japanese investors typically focused on the AAA tranches and investors from other regions investing throughout the tranches. So, what have these investors been seeing? A potentially overwhelming amount of supply. As the LSTA Chart indicates, at around $120 billion, CLO issuance, refis and resets are at remarkable levels. In fact, thanks to the onslaught, in April CLO spreads reversed their tightening trend. After brushing the low 90s in March, the average CLO AAA spread climbed back to LIB+103. The near term pricing trend may be up as managers, no longer chained by risk retention constraints, look to do new CLOs. Meanwhile, equity investors continue to chafe at worsening arbitrage as loan yields (often priced over one-month LIBOR) tighten faster than CLO WACC. In turn, they are incented to refi or reset deals. As a result, not only is supply high, but bankers, managers, investors, rating agencies and lawyers are running as fast as they can. Ultimately, human capital – not risk retention capital – might be the ultimate constraint on 2018 CLO issuance.

tranches and investors from other regions investing throughout the tranches. So, what have these investors been seeing? A potentially overwhelming amount of supply. As the LSTA Chart indicates, at around $120 billion, CLO issuance, refis and resets are at remarkable levels. In fact, thanks to the onslaught, in April CLO spreads reversed their tightening trend. After brushing the low 90s in March, the average CLO AAA spread climbed back to LIB+103. The near term pricing trend may be up as managers, no longer chained by risk retention constraints, look to do new CLOs. Meanwhile, equity investors continue to chafe at worsening arbitrage as loan yields (often priced over one-month LIBOR) tighten faster than CLO WACC. In turn, they are incented to refi or reset deals. As a result, not only is supply high, but bankers, managers, investors, rating agencies and lawyers are running as fast as they can. Ultimately, human capital – not risk retention capital – might be the ultimate constraint on 2018 CLO issuance.

The LSTA would like to thank its more than 700 attendees, as well as its sponsors and exhibitors, including Alcentra, Ares, BAML, Blackrock, BNP Paribas, Credit Suisse, Deutsche Bank, DFG Investment Advisors, Eaton Vance, Golub Capital, GSO Capital Partners, Highland Capital, Invesco, Investcorp, Jefferies, King Street, Marathon Asset Management, Morgan Stanley, MUFG, Nomura, Nuveen, Oak Hill Advisors, Octagon, Onex, Pinebridge Investments, Shenkman, Sound Point Capital, SuMi Trust, Symphony, Voya, AlterDomus, Bloomberg, Finastra, Fitch Ratings, IHS Markit, and S&P Global.