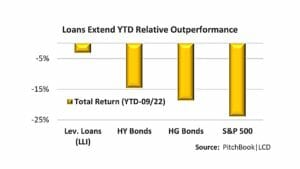

October 6, 2022 - While the Morningstar LSTA Leveraged Loan Index (LLI) still produced a 1.37% return across the third quarter, the trend was not encouraging: After rallying in July and early August, prices in the secondary loan market tumbled in September. September’s negative 2.27% return sank the loan market’s YTD return to -3.25% – which is now tracking to its first annual loss since 2015 and just the third annual loss on record. Furthermore, September marked the third time since May where returns were not only negative, but worse than -2%. That all said, loans still outperformed all other asset classes in September (and in third quarter) while increasing its extraordinary YTD relative outperformance to other asset classes. Compare the alternatives: HY bonds (-14.6%), HG bonds (-18.7%), and equity (-23.9%).

But let’s head back to September’s secondary loan market where market breadth ran decisively bearish. In September, the market’s advancer/decliner ratio deteriorated to 0.08:1 (from 5.3:1 in August), with just 7% of loan prices advancing and 90% declining. Even worse, more than 10% of loan prices were down 5% or more during the month – a quantum not seen since the March 2020 sell-off. In turn, the market’s average bid level sank a notable 263 basis points across September, to 91.92, nearly retracing July’s low water mark of 91.74. Bid levels are now down more than 700 basis points since early January when the secondary market was bid at 99. While prices in the secondary approached their 2022 lows in September, the market’s average bid-ask spread increased 12 basis points, to 143 basis points, marking the first time the spread crossed 140 basis points since November 2020. But economic conditions were far different then. The market was trading roughly 275 basis points richer in November 2020, as traders were pricing in that the worst was behind us, not in front of us. The opposite seems to be the case in late 2022, according to a recent survey of market participants by PitchBook/LCD. The survey noted that 60% of respondents felt “the worst is yet to come in regard to volatility levels in the leveraged credit markets”, while just 40% believed the LLI has “hit its lows of the credit cycle”. The foremost reason for the pessimism in today’s market is the ongoing threat of a downward shift in credit quality – which some would argue began several months ago. In June, the trailing 3-month rating downgrade/upgrade ratio began favoring downgrades for the first time since January 2021. And over the past four months, the ratio has worsened from 1.32 to 2.28. Furthermore, according to the LLI, the default rate (by dollar amount) increased to 0.90% in September- the highest default level since June 2021. But at least in the short term, the secondary loan market has started the fourth quarter in rally mode, with prices up by 65 basis points during the first three trading sessions of October. Time will tell if the September loan market was truly oversold or if the survey results will prove to be correct.