December 15, 2022 - In November, the UK’s Financial Conduct Authority (“FCA”) announced that it was consulting on its intention to compel the ICE Benchmark Administration (“IBA”) to publish a non-representative synthetic USD 1-, 3- and 6-month LIBOR from July 1, 2023 to September 30, 2024 for use in certain legacy LIBOR contracts. But what exactly is “synthetic USD LIBOR” – and what does it mean for legacy loans in the US? Bottom line is that it likely helps pre-2018 loans, it doesn’t affect loans with ARRC fallback language, and it may have implications for loans originated 2018-2022 that have fallback language, but no “non-representative” transition trigger. We explain all – mostly in English! – below.

Helpful background. LIBOR afficionados might recall that the FCA had previously required the IBA to publish certain tenors of synthetic Sterling LIBOR and Yen LIBOR for a period of time. The objective was to give “hard legacy” LIBOR contracts with no way of transitioning from LIBOR to a replacement rate more time to actively transition; meanwhile most LIBOR contracts that had fallback language would automatically transition to a replacement rate when their LIBOR panel rate ceased. For both Sterling and Yen, the synthetic LIBOR rate was the fallback reference rate (Term SONIA in the case of Sterling) plus the ISDA spread adjustments. In other words, synthetic LIBOR was the same rate to which most hardwired cash contracts would fall back. Critically, the FCA also stated that this synthetic LIBOR would be “permanently unrepresentative”; in other words, it did not represent what panel LIBOR might be if it had continued to be published. Thus, contracts that included a trigger to transition from LIBOR when it is no longer representative would therefore convert to a replacement rate on schedule.

What does this mean for US loans? First, it is important to note that US federal legislation (the “LIBOR Act”) does not affect the vast majority of US syndicated loans – but the FCA synthetic LIBOR may do so. Assuming that the FCA will compel the IBA to publish nonrepresentative synthetic 1-, 3- and 6-month LIBOR settings from July 1, 2023 to September 30, 2024, different vintages of loans may behave differently. In the institutional loan market, we can roughly divide the universe of outstanding loans into three categories: 1) Pre-2018 loans that do not have intentional LIBOR fallback language; most of these loans do have a “Prime” option that can be used if LIBOR is unavailable. According to Covenant Review (“CR”), this is about 9.5% of the CS Index. 2) Loans with hardwired or amendment fallback language that include a trigger to transition from LIBOR once it is determined to be “no longer representative”. Loans with ARRC hardwired or amendment fallback language – about 45.6% of the CS Index, according to CR – have this “non-representative” trigger (often also referred to as the “pre-cessation trigger”). ARRC fallback language became broadly more prevalent starting in 2020. Meanwhile, some – but perhaps not many –loans with non-ARRC fallback language may have this trigger, CR adds. 3) Loans that have fallback language, but do not have a “non-representative” trigger. This language may be more prevalent in loans originated between 2018 and 2020.

Pre-2018 loans and loans with “non-representative triggers” have a fairly clear path. For the pre-2018 loans with no intentional fallback language, synthetic LIBOR likely is a boon. These loans would otherwise shift to Prime (currently 7.5%). If they simply used synthetic LIBOR on a screen, it would be Term SOFR plus the ARRC spread adjustment (currently 4.43% for 1M, 4.77% for 3M). From the borrowers’ perspective, synthetic LIBOR is a clear win. For loans that have fallback language including a “non-representative” trigger, there is no change from the current situation; they would simply transition from LIBOR to their replacement rate on or around June 30, 2023 (or earlier if they have an early “opt-in” trigger).

What about loans with fallbacks, but without non-representative triggers? The analysis is more interesting for the universe of roughly 2018-2020 loans that have fallback language, but do not have a non-representative trigger to transition from LIBOR. It would appear that, barring any early opt-in transitioning, these loans largely could continue to use the synthetic LIBOR that is on the screen. However, there is some interesting game theory here. First, the existence of synthetic LIBOR could act as a pressure valve if it proves impossible to transition all these loans before or around end-June 2023. And, from a borrower perspective, it is more attractive to be on synthetic LIBOR (TSOFR+ARRC spread adjustment) than Prime (where loans end up if transition amendments are not successfully completed by end-June 2023).

But there is an economic argument for transitioning early. Loans without non-representative triggers should still try to switch rates prior to LIBOR cessation. Synthetic LIBOR would be TSOFR plus the ARRC CSAs, which are 11 bps for 1M SOFR and 26 bps for 3M. In contrast, according to LevFin Insights, 10 bps is the predominant flavor of CSA for new loans (that have CSAs) as well as for a number of loans – like Hilton, Iridium and Nouryon – that have recently done an amendment fall back to SOFR. Thus, if a borrower would like to use a 3-month tenor, a market standard 10 bps CSA will be much more attractive than an ARRC 26 bps CSA. (To quantify the benefit, consider Hilton’s amendment fallback. Hilton’s $2.6 billion TLB is switching to TSOFR+10 bps, LevFin Insights reported. If it used 3M interest rate contracts, Hilton would save more than $4 million a year by using a 10 bps CSA rather than the ARRC’s 26 bps CSA.)

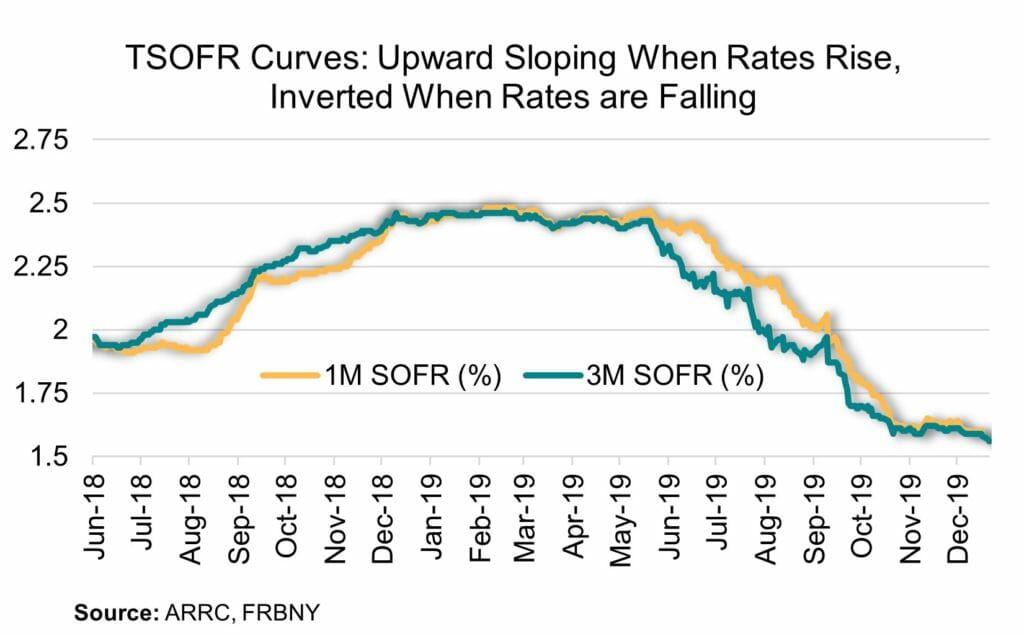

Who cares about 3-month interest rate tenors? To be fair, many institutional loans currently are using 1-month interest contracts, and therefore the 1M CSA might be the most relevant. However, this could change. Term SOFR’s term curve – i.e., the difference between 1-, 3-, and 6-month TSOFR – behaves differently than the LIBOR curve. Term SOFR is simply the expectation of the rate that daily compounded SOFR would accrue to in one month or three months. If the markets are anticipating a near-term interest rate increase, then 3M Term SOFR will be higher than 1M Term SOFR. If the markets are anticipating an interest rate cut, then 3M Term SOFR will be lower than 1M Term SOFR. (A quick numerical example: Suppose Daily SOFR is 150 bps, but rates are expected to be cut to 100 bps in 15 days. 1M Term SOFR would be the expectation of 15 days of 150 bps and 15 days of 100 bps SOFR. In contrast, 3M TSOFR would be the expectation of 15 days of 150 bps daily SOFR and then 75 days of 100 bps daily SOFR.) The COW confirms this relationship: When interest rates were increasing in 2018, 3M SOFR was higher than 1M SOFR. When interest rates were decreasing in 2019, 1M SOFR was higher than 3M SOFR.

The bottom line: The FCA’s consultation is not final. However, if it goes live in the current format, it will be a boon for borrowers with pre-2018 loans without formal fallback language that would otherwise go to Prime and it would not affect loans that have a “non-representative” trigger. Borrowers that have loans with fallback language without a non-representative trigger may still find “opting in” early to be economically advantageous; however, synthetic LIBOR might act as a pressure valve if not all these loans transition by June 30, 2023.