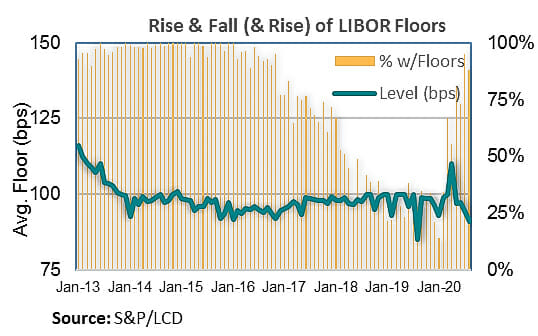

August 17, 2020 - With LIBOR falling from nearly 1.7% in February to around 25 bps today, it should be little surprise that LIBOR floors are back in fashion in the institutional loan market. According to S&P/LCD, less than one-third of loans had LIBOR floors between July 2019 and February 2020. Then COVID-19 struck the U.S., interest rate policy plunged toward zero – and floors came back. By July, 95% of new institutional loans had a LIBOR floor. While the most typical LIBOR floor in recent years is 100 bps, the COW demonstrates that the levels do vary. (As an aside, interest rate floors are expected in the SOFR world and the ARRC SOFR Conventions for Syndicated Loans explain how they would likely work.)