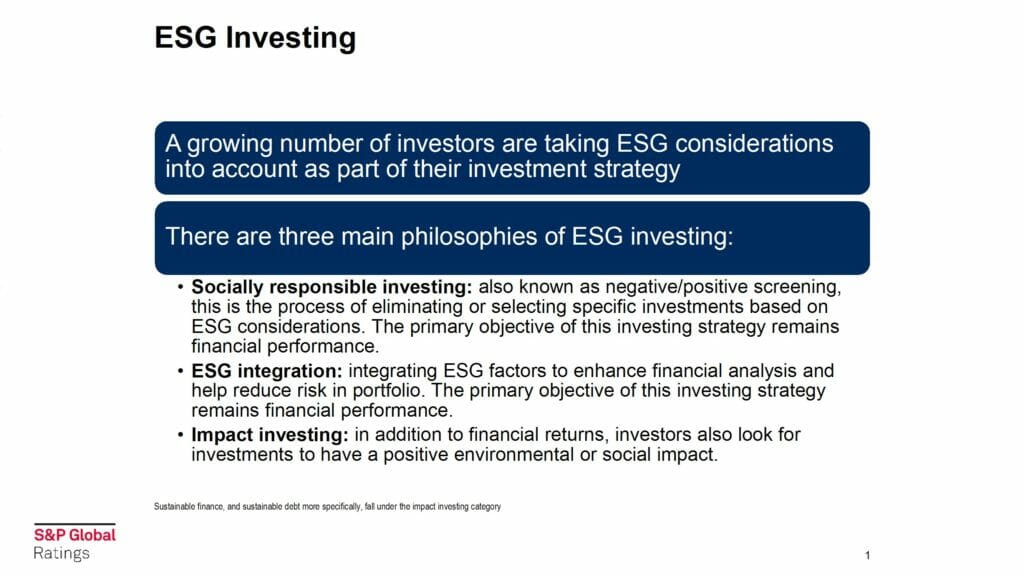

ESG is an increasing issue for credit quality, and financial market stakeholders are identifying a growing number of ESG-related risks. Join us for a discussion with S&P experts on how the extent of ESG risks are measured, and how S&P compares issuers who are increasingly trying to reduce their exposure to ESG risk. This session is the first in a three-part series on how credit rating agencies are addressing ESG risks. Presented by Michael Ferguson, Senior Director, Sustainable Finance, S&P Global Ratings, Paul Kalinauskas, Director, Structured Credit Group, S&P Global Ratings and Tess Virmani, Associate General Counsel, EVP Public Policy, LSTA.

| File | 092321-Slides_SP-Global-ESG-CLOs-for-LSTA.pdf |

|---|