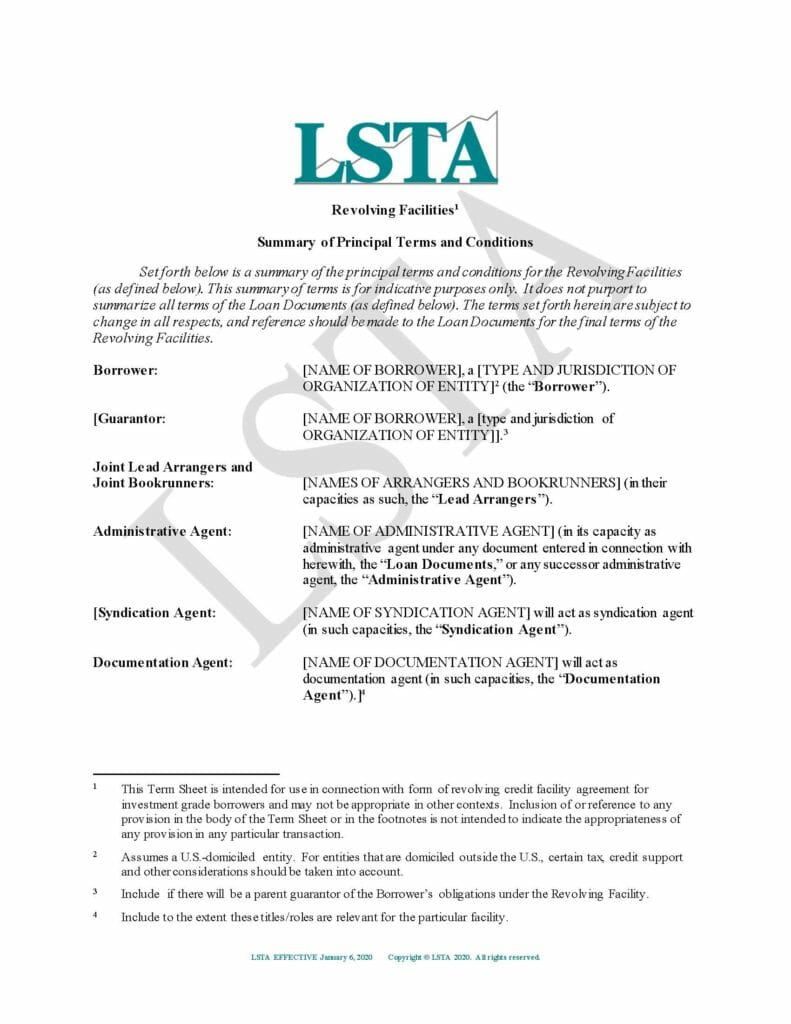

Is designed to be used for revolving credit facilities for investment grade borrowers. The detailed term sheet can be used with the LSTA’s credit agreement, the LSTA’s Form of Investment Grade Revolving Credit Facility Agreement published in October 2017 and contemplates letters of credit, swingline loans, and competitive bid loans (which have been included more for reference given that they are rarely used in today’s market). it also makes reference to representations, covenants, and events of default that would be typical for IG borrowers. We plan to work with Professor Aaron Wright of Cardozo Law School and his team at OpenLaw to automate the term sheet.

| File | LSTA-Investment-Grade-Revolving-Credit-Facilities-Term-Sheet-January-6-2020.docx |

|---|