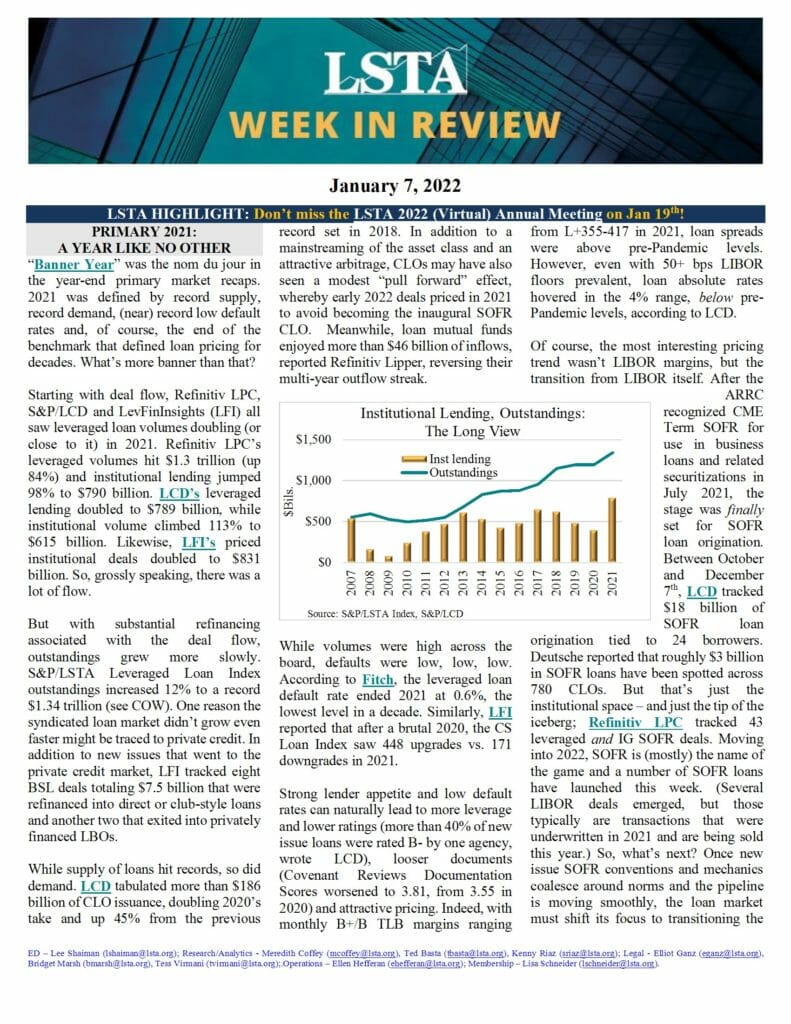

This week we cover Meredith Coffey reviews the remarkable 2021 Primary Market, Ted Basta analyzes the Secondary’s 5 Percent, Elliot Ganz explains why Purdue could change everything, Tess Virmani reminds members of our voluminous SOFR Suite of Docs and Elliot Ganz rejoices that a LIBOR Litigation disaster was averted.

Downloads

| File | Week-in-Review-01-07-22.pdf |

|---|