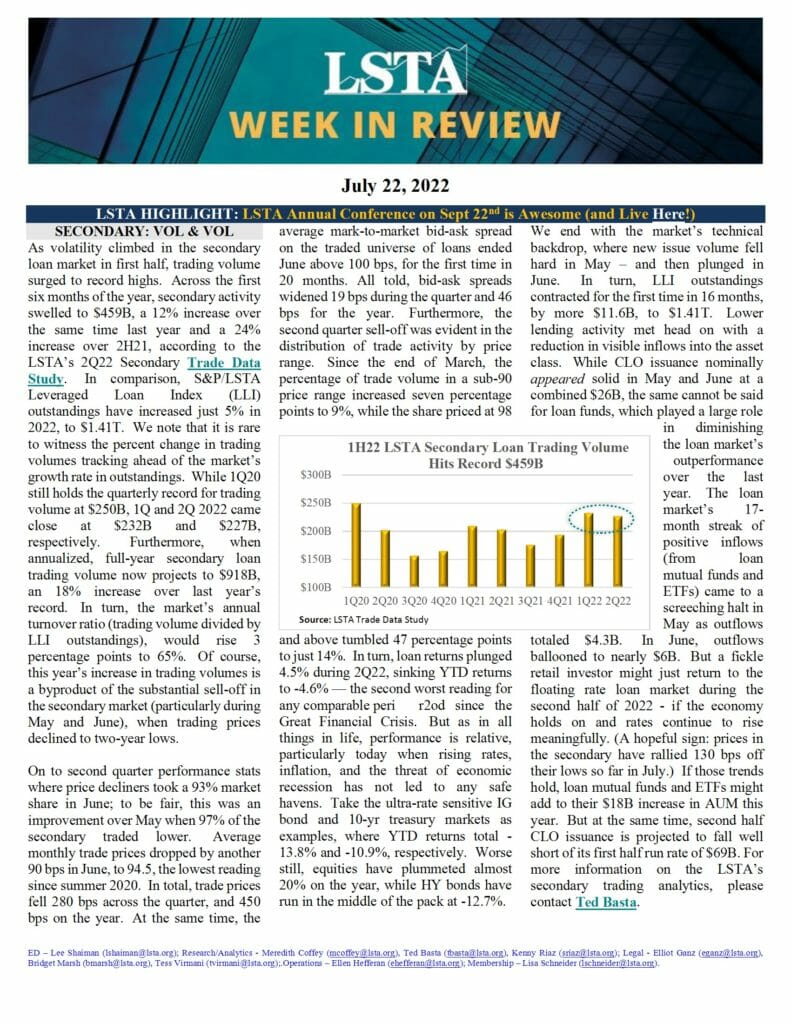

This week in review Ted Basta discusses record 1H22 trading volume (and near-record vol), Tess Virmani provides an update on proposed SEC ESG Rules that would affect nearly every RIA in the loan market, Meredith Coffey recaps the LSTA’s response to the NAIC’s proposed changes in risk based capital for insurance companies, Bridget Marsh reviews takeaways from the Summer Series session on Middle Market vs BSL loans, Meredith Coffey flags the Fed’s Proposed Rulemaking on LIBOR legislation and Kenny Riaz and Ted Basta announce the opening of the 2022 LSTA Annual Conference (!!)

| File | Week-in-Review-07-22-22.pdf |

|---|