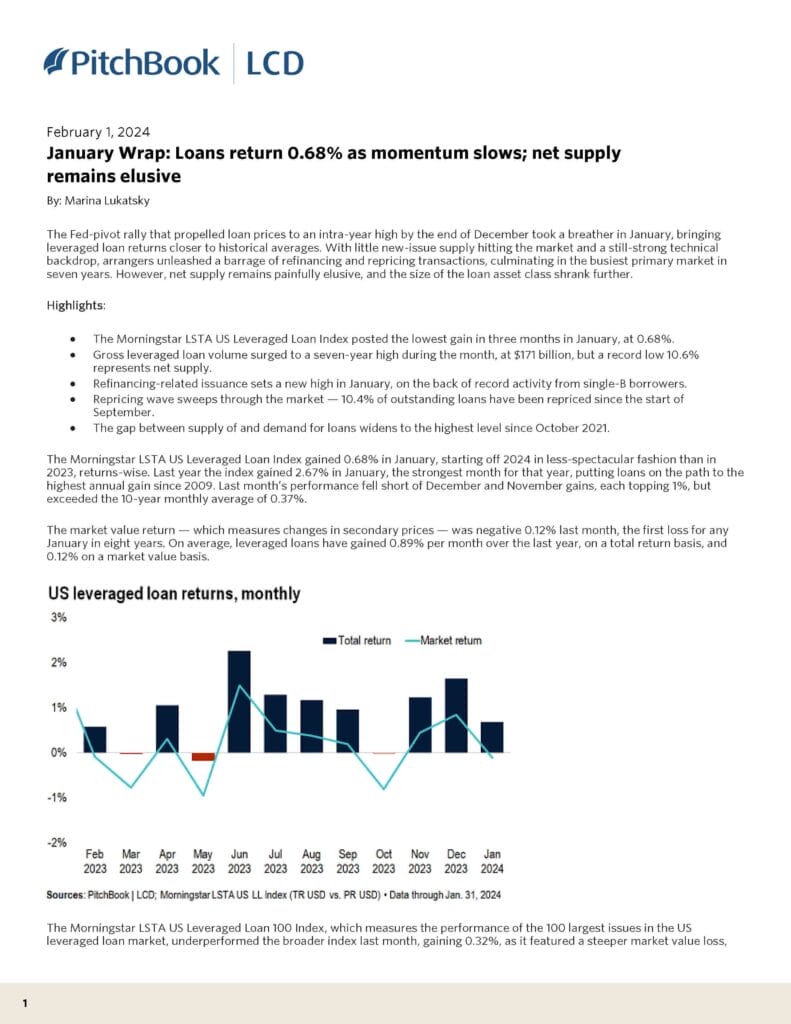

The Fed-pivot rally that propelled loan prices to an intra-year high by the end of December took a breather in January, bringing leveraged loan returns closer to historical averages. With little new-issue supply hitting the market and a still-strong technical backdrop, arrangers unleashed a barrage of refinancing and repricing transactions, culminating in the busiest primary market in seven years. However, net supply remains painfully elusive, and the size of the loan asset class shrank further. Marina Lukatsky of Pitchbook LCD wrote this.

| File | January-2024-US-Leveraged-Loan-Index-Monthly-Wrap.pdf |

|---|