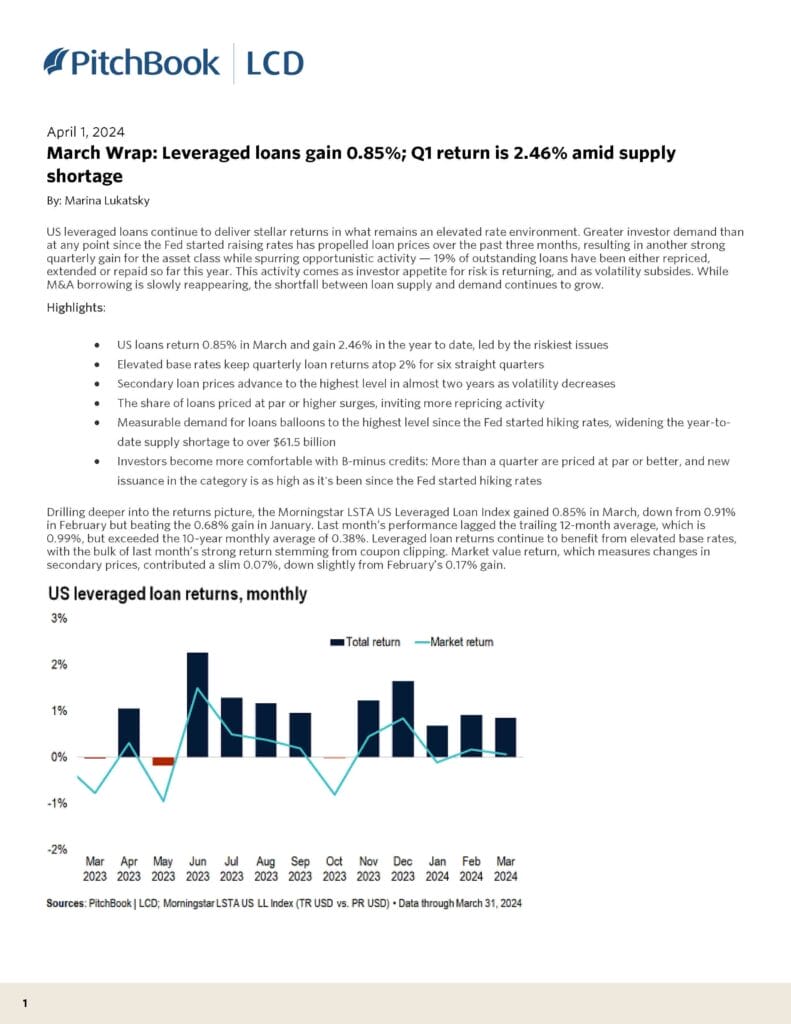

US leveraged loans continue to deliver stellar returns in what remains an elevated rate environment. Greater investor demand than at any point since the Fed started raising rates has propelled loan prices over the past three months, resulting in another strong quarterly gain for the asset class while spurring opportunistic activity — 19% of outstanding loans have been either repriced, extended or repaid so far this year. This activity comes as investor appetite for risk is returning and as volatility subsides. While M&A borrowing is slowly reappearing, the shortfall between loan supply and demand continues to grow. Marina Lukatsky of Pitchbook LCD wrote this.

| File | March-2024-US-Leveraged-Loan-Index-Monthly-Wrap.pdf |

|---|