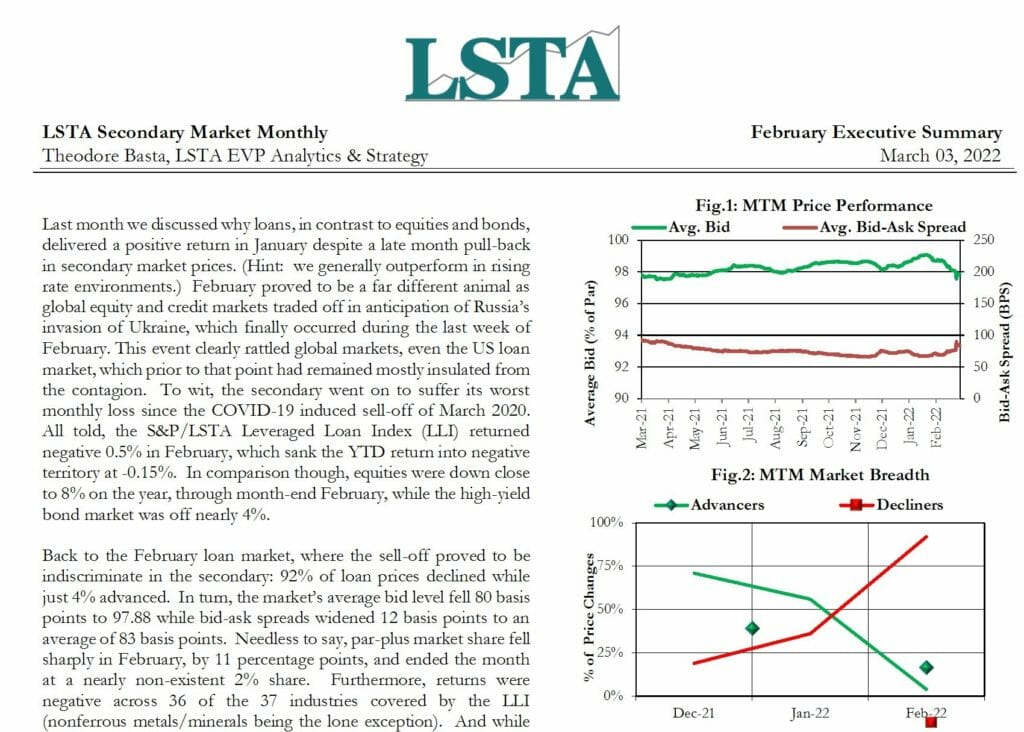

Last month we discussed why loans, in contrast to equities and bonds, delivered a positive return in January despite a late month pull-back in secondary market prices. (Hint: we generally outperform in rising rate environments.) February proved to be a far different animal as global equity and credit markets traded off in anticipation of Russia’s invasion of Ukraine, which finally occurred during the last week of February.

| File | Secondary-Market-Monthly-February-2022-Executive-Summary.pdf |

|---|