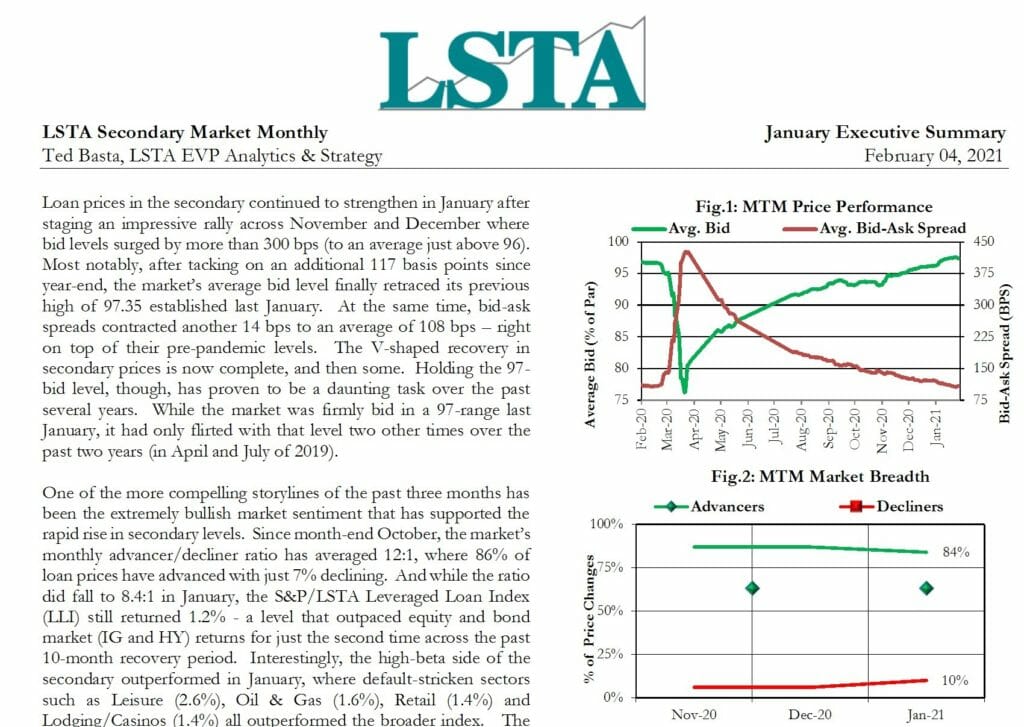

Loan prices in the secondary continued to strengthen in January after staging an impressive rally across November and December where bid levels surged by more than 300 bps (to an average just above 96). Most notably, after tacking on an additional 117 basis points since year-end, the market’s average bid level finally retraced its previous high of 97.35 established last January.

| File | Secondary-Market-Monthly-January-2021-Executive-Summary.pdf |

|---|