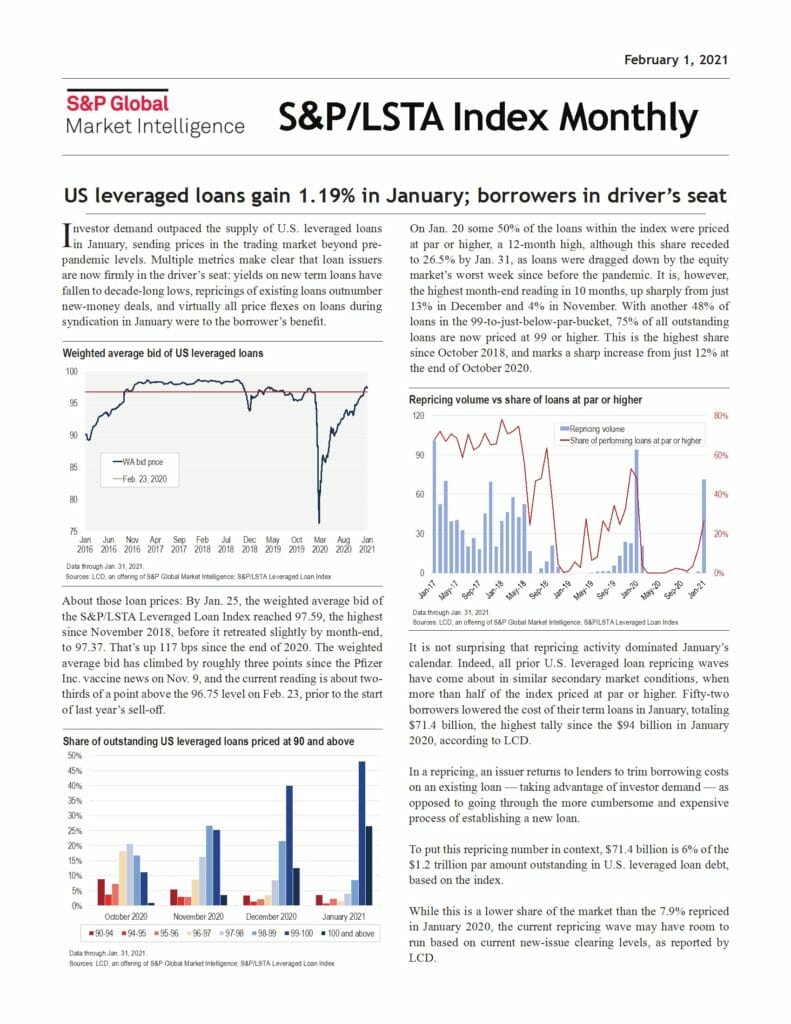

Investor demand outpaced the supply of U.S. leveraged loans in January, sending prices in the trading market beyond pre-pandemic levels. Multiple metrics make clear that loan issuers are now firmly in the driver’s seat: yields on new term loans have fallen to decade-long lows, repricings of existing loans outnumber new-money deals, and virtually all price flexes on loans during syndication in January were to the borrower’s benefit.

| File | Index-Monthly-January-2021.pdf |

|---|