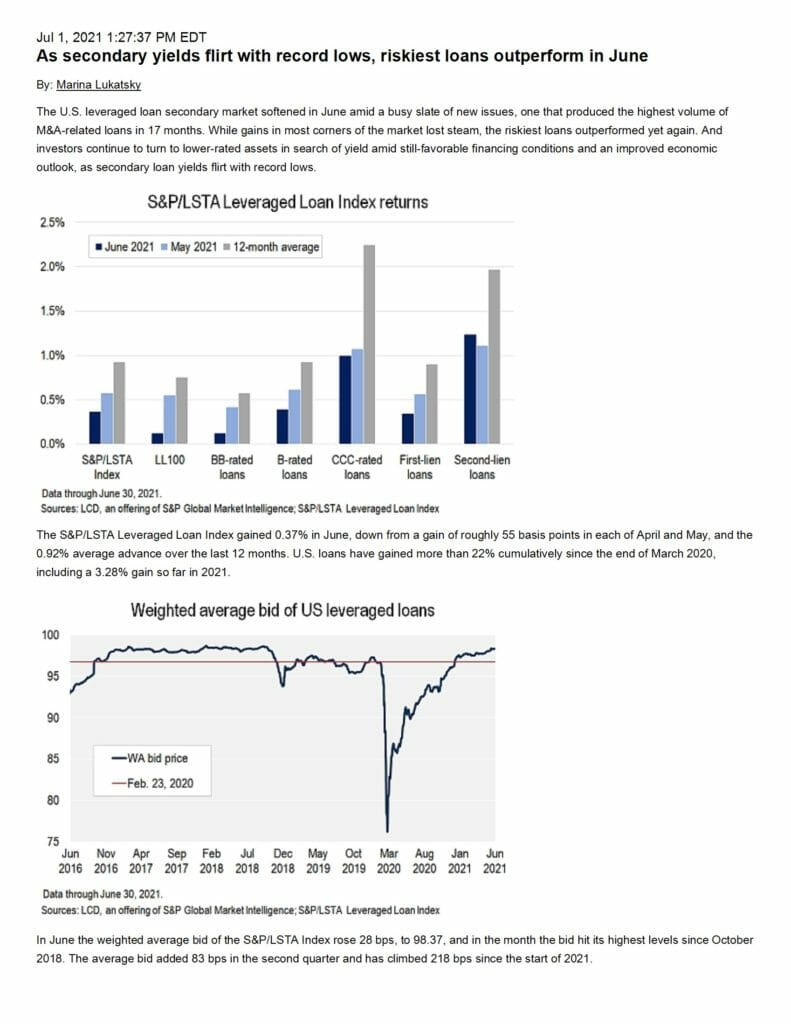

The U.S. leveraged loan secondary market softened in June amid a busy slate of new issues, one that produced the highest volume of M&A-related loans in 17 months. While gains in most corners of the market lost steam, the riskiest loans outperformed yet again. And investors continue to turn to lower-rated assets in search of yield amid still-favorable financing conditions and an improved economic outlook, as secondary loan yields flirt with record.

| File | Index-Commentary-June-2021.pdf |

|---|