Despite the undeniable rise of ESG integration both in investment strategies and financial products over the last few years, 2021 looks set to be the start of a new chapter in the ESG story – particularly in the U.S. Members joined us for an expert discussion on what we should expect to see this year from sustainable finance and market developments to calls for greater ESG disclosure and standardization of ESG data.

EVENT DETAILS

Tuesday, February 2, 2021

11:00AM to 12:00PM (ET)|Webcast Only

Presentation, Recap and Replay|Now Available|Scroll Down to View

1 CLE Credit Will Be Issued

MODERATOR / SPEAKERS

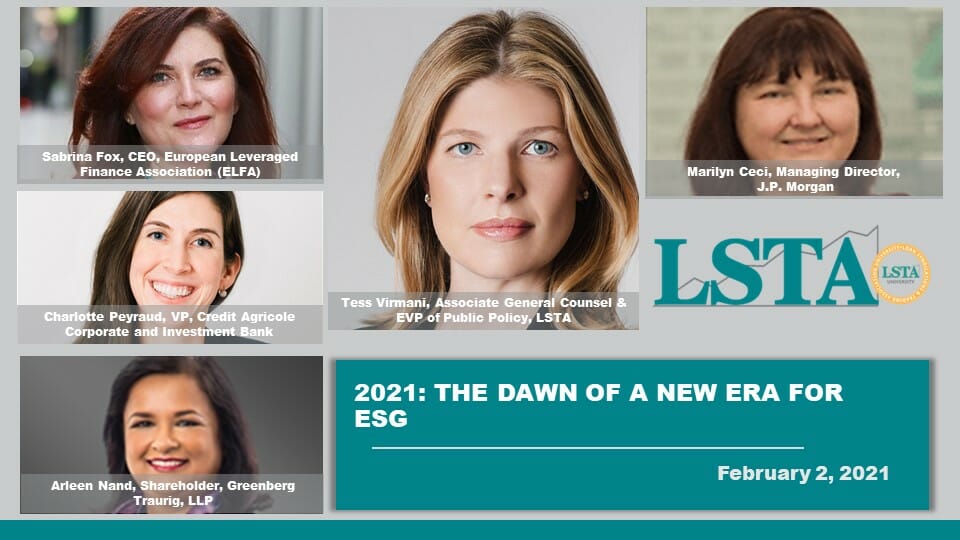

- Marilyn Ceci – Managing Director, Global Head of ESG Debt Capital Markets, J.P. Morgan

- Sabrina Fox – Chief Executive Officer, European Leveraged Finance Association (ELFA)

- Charlotte Peyraud – Vice President, Sustainable Banking Americas, Credit Agricole Corporate and Investment Bank

- Arleen Nand – Shareholder, Greenberg Traurig, LLP – Moderator

- Tess Virmani – Associate General Counsel & Executive Vice President, Public Policy, LSTA