October 5, 2022 - Anyway you slice it, 3Q22 did not end well. Lending volumes were down and interest costs were up. And while secondary prices ended within 20 bps of where they started, they also rallied – and then fell – roughly four points in-between. We discuss the trends, numbers and outlook below.

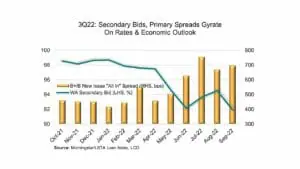

Real time sentiment may be best tracked in the secondary loan market. On that metric, third quarter started on a positive note. Secondary prices rallied nearly four points, climbing from 91.75 early in the quarter to 95.5 on August 12th. But then the interest rate rhetoric grew more hawkish, economic sentiment grew more bearish, and the secondary gave those four points back, ending the quarter at 91.93.

Looking at new issue volumes, the trend was clear: Down. The bigger analytical challenge was finding sufficiently draconian comps. LevFin Insights (LFI) compared 3Q22 to every quarter since the firm opened their door six years ago. It was consistently dour. Gross institutional lending tumbled to $23 billion, down 62% and 86% from 2Q22 and 3Q21, respectively. It also was the lowest gross volume in the six years since LFI opened its doors.

LCD, whose doors have been open longer, preferred to comp to the Global Financial Crisis (GFC). They pegged institutional lending at $21.4 billion, off 86% year-over-year (and the lowest level since the GFC).

Things were marginally sunnier over at Refinitiv LPC, who tracks the higher rating spectrums along with leveraged credit. And, indeed, the higher the credit quality the better (or less bad) the performance. Their 3Q22 institutional lending fell 73% year-over-year (to $44 billion); leveraged (including pro rata) was down 45% (to $164 billion). Meanwhile, third quarter investment grade lending slid just 7%, to $193 billion, relative to year-earlier figures.

While volumes were historically low, yields felt astronomically high. With the secondary market ranging between 91.75 and 95.5 during the quarter, discount margins soared. Secondary spreads in the B-rated Loan Index jumped from 443 bps at the end of December to 716 bps at the end of September. To compete, new issues had to offer high margins and higher OIDs. LFI reports that July’s average OID of 92.88 was the steepest on record since, well, it opened its doors six years ago. In turn, all-in spreads (including a 3-year amortized OID) on new issue B rated loans jumped from 457 bps in 4Q21 to 694 bps in 3Q22. And then there’s the reference rate. Term SOFR soared from nearly nothing in January to more than 350 bps by the end of third quarter. The result? New issue B+/B rated loan yields more than doubled from 4.4% in January to 9.8% in September.

Who would issue into such a market? Not an opportunist, the publishers chorused. LCD tracked $2.6 billion of institutional refinancings (lowest since the GFC!) and LFI saw $3.2 billion of opportunistic activity (lowest since LFI opened their doors!). But at least there’s schadenfreude: In the high yield bond market, issuance was down to a mere $19 billion, LCD wrote. In case you were wondering, it was indeed the lowest quarterly volume since the GFC.

What did take place in third quarter? Painful jumbo deal selldowns, pro rata activity and direct lending. In stress periods, painful jumbo selldowns and climbing pro rata share are both predictable and cyclical. What might – or might not – be more secular is the rise of Private Credit (PC). Second quarter saw a flurry of would-be BSL mandates shifting to the private market. In third quarter, nearly $5.4 billion of BSL loans were repaid via a private credit deal, LFI wrote. While some lenders worry that PC will disrupt the BSL market, LSTA conference speakers generally felt the two markets would coexist peaceably. Where do we go from here? While the first few days of fourth quarter were cheerier, lenders and commentators ended 3Q on a pessimistic note. As discussed last week, Fitch increased its default forecast to 2-3% for 2023 and 3-4% for 2024. While default rates are likely to go up, lenders think loan prices may go down. According to LCD’s quarterly survey, 62% of respondents think that secondary prices have not yet hit their lows of the credit cycle. With luck, that is a contrarian indicator.