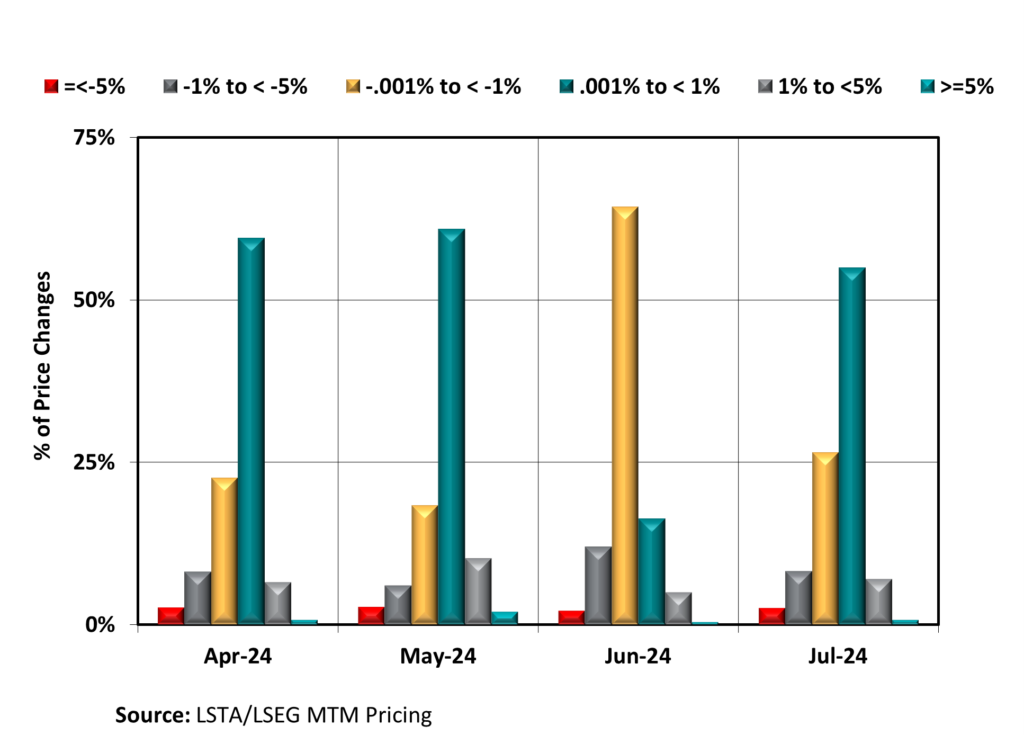

August 7, 2024 - Broadly syndicated loans (BSL) traded sideways across July, with the average price of the Morningstar LSTA Leveraged Loan Index (LLI) closing the month at 96.6, with no change observed in nearly half of the month’s trading sessions. Across the underlying loans in the index, 82% recorded price changes of less than 1%. While July’s total return of 0.68% was an improvement over the previous month, when a softer secondary sent loans to its lowest return this year, market value losses persisted for the second consecutive month and three of the past four months. Returns in 2023 have been primarily driven by interest income, which added 0.78% and 5.52% to July’s and year-to-date total return, respectively, mainly on account of high SOFR. Interest income has offset the 0.38% of market value losses so far this year.

In contrast to BSL, the average price on U.S. high-yield bonds jumped 136 basis points in July, driving total return to 1.94%, per the Bloomberg U.S. High-Yield Corporate Bond Index. July represented HY bonds’ best performance in seven months as financial markets reacted to possible interest rate cuts from the Federal Reserve by going long on fixed rate bonds. For the year-to-date, HY bonds are returning 4.58%, trailing the 5.12% return from BSL.

Turning back to the secondary loan market, July’s activity saw advancers outpace decliners by the smallest margin in 10 months, with 57% of the constituents in the LLI ending the month with a higher price, and 34% registering a lower mark. This narrowing of breadth sent the share of the market priced above par slightly higher to 44%, from 37% in June, but below May’s high mark of 52%. Bucking the trend this year, the riskiest loans underperformed as average prices on CCC rated loans declined 49 basis points and B- rated loans (which make up the largest share of the LLI at 23%) ended July 21 basis points lower. In contrast, BB rated loans were up 11 basis points in the month for a total return of 0.80%. For the year to date, returns from CCC (6.45%) and B- loans (5.53%) remain firmly ahead of the benchmark LLI.

In contrast to the flat secondary market, July saw some green shoots coming from the primary market in the form of higher LBO and M&A lending. According to Pitchbook LCD, 28% of lending in July represented new loan supply, the highest since January 2022, as the pace of refinancings and repricings declined from 1H24’s lofty levels.

Despite the welcomed increase in new loan supply, the imbalance between investor demand and net loan supply remained a theme with record CLO issuance and the highest retail fund inflows since 2022 eclipsing the scant supply coming from the primary market. Outstandings in the LLI have declined 0.43% (or $6B) so far this year and stand 3% lower since the peak in October 2022. In contrast, CLO issuance stands at $113B so far this year, with July’s volume adding $11.7B over 26 deals.

Back to the secondary, loans have been trading sideways since mid-May, when inflation readings reverted to market consensus. Across June, loans declined 34 basis points after the Fed’s interest rate decision on June 12, as investor demand ebbed in line with interest rate projections for the rest of the year. In sum, loans declined in 15 of 20 trading sessions in June translating to 72% of loans declining in value, compared to 20% advancing. It was the first time since January decliners led advancers, with most loans (64%) experiencing modest markdowns of less than 1%. Nevertheless, it was enough to send the share of the LLI priced above par lower from a six year high 52% in May to 37% by the end of June. The pull back in prices widened the average bid-ask spread to 88 basis points – the first time this metric has widened in 2024 after tightening from 100 basis points at the start the year.

Driving performance has been a slowdown in demand for BSL from key constituencies. Issuance of new CLOs, the biggest buyers of BSL, declined 50% month-over-month to $11.7B in June, the lowest issuance total this year, after averaging $16.8B in the prior months to propel CLOs to the busiest first half on record. Although less paper was printed, AAA liability spreads tightened to an average of 145 basis points in June, with several top-tier managers printing as low as 138 basis points.

Although CLO issuance is below the breakneck pace from earlier in the year, it remains robust with average spreads for new-issue BSL CLOs tightening a further six basis points in July to 139 basis points over SOFR. For their part, loan mutual funds and ETFs registered inflows of $2.7B in July and $14.8B year-to-date, per LSEG Lipper. Visible demand (measured by CLO issuance and loan fund flows) continued to outpace supply by approximately $16B in July and $133B YTD.

The prospect of declining interest rates may offer some respite for credit fundamentals. Key stress indicators in the market appear manageable, with 7% of secondary market loans priced below 80, and the proportion of LLI constituents rated CCC or B- remaining stable at 6.2% and 22% respectively. And while default rates have climbed since the Federal Reserve began its tightening cycle in April 2022, recent data from Fitch Ratings shows a slight improvement, with the trailing 12-month (TTM) institutional loan default rate easing to 4% in June, from 4.3% in May.