July 7, 2020 - By Lee Shaiman, Executive Director, Loan Syndications & Trading Association

A recent internet meme posits that the U.S. banking system is on the precipice of collapse. Today’s catalyst, the Collateralized Loan Obligation or CLO, the theory goes, bears a resemblance to the similarly named CDO, which played a role in the 2008 financial crisis. We disagree with the central thesis for many reasons but will focus our attention today on i) the fact that CLOs comprise a minor holding among banks that own them and ii) the low level of risk that these AAA-rated securities represent. We recently re-examined the resilience of CLO AAA rated tranches in an article entitled, “Could CLO AAA Notes Suffer Significant Credit Losses?” That analysis tested default rates that were multiples of historical peaks and recovery rates up to 27 percentage points below historical norms. We concluded in that… “it is very hard to create principal losses on CLO AAA notes.” It would take a protracted economic cataclysm causing significant credit losses across a broad range of economic sectors to realize anylosses in CLO-AAA notes.

If CLO AAA notes carry a very small risk of principal loss then why all the drama? The theory contends that banks have thwarted reform and hold outsized positions in these CLO securities, implying that even small risks, due to large positions, will result in unsustainable losses for important banks. So how much of the approximately $688 billion CLO market do U. S. banks own? Although CLO securities are issued in the institutional private placement market, there is good visibility into the portion of the market held by the approximately 5,300 U.S. depository institutions insured by the FDIC. First, only 137 FDIC insured banks or bank holding companies, approximately 2.6% of all institutions, hold CLO notes. As of March 31, 2020, those 137 banks held $104 billion of U.S. CLO notes. While $104 billion may appear to be a large number, in fact, CLO notes are a minor holding within the banking system when compared to the approximately $19 trillion of assets of all U.S. commercial banks as of June 10, 2020[1].

We then looked at U.S. banks’ CLO holdings as a percentage of the each bank’s Tier-one capital (which is essentially the equity capitalization of the bank). Using a very conservative approach, under Basel III, the international regulatory framework, banks are required to maintain 7% Tier-one capital ratio (minimum of 4.5% plus a 2.5% common equity tier 1 capital conservation buffer). The Federal Reserve Bank of New York reported an industry average of 12.24%[2]. This ratio is an indication of a bank’s ability to absorb losses in its risk-weighted assets.[3]

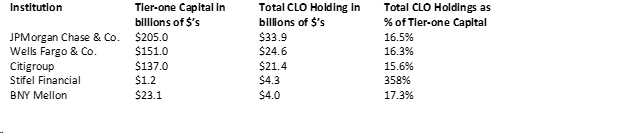

Next, let’s compare the capital ratios to CLO holdings. Five institutions held $88.2 billion or approximately 85% of all bank holdings of CLOs. JPMorgan, Wells Fargo and Citigroup are well capitalized banks with tier-one ratios of 12.39%, 11.81% and 11.14%, respectively, through the end of Q4, 2019[4] and also held the highest CLO investments. The following table shows a breakdown of the largest 5 banks by CLO holdings and their respective tier-one capital levels.

JPMorgan Chase, Wells Fargo, Citigroup and BNY Mellon are listed by the Financial Stability Board as globally systemically important banks and are well capitalized in comparison to the risks presented by the CLO holdings of each institution. Notably even if JP Morgan, Wells Fargo and Citigroup all saw their CLO portfolio values fall to zero, they still would have Tier one Capital Ratios of nearly 10% or more – nearly 1.5 times the minimum Tier one Capital Ratio required under the Basel III framework.

The math shows that CLO holdings simply are not a source of systemic risk to the banking system. The aforementioned paper demonstrated that the probability of any CLO AAA note losses were miniscule. Today’s analysis demonstrates that even if there were substantial CLO AAA note losses, the banking system would be well positioned to absorb any such losses. The U.S. has many real problems to handle right now; we should not be obsessing on issues or looking for problems that are extraordinarily remote.

[1] Federal Reserve Financial Institutions Examination Council, FRED-St. Louis FED

[2] Quarterly Trends for Consolidated U.S. Banking Organizations, Fourth Quarter 2019. Federal Reserve Bank of NY

[3] It is also worth noting that banks hold only a very small part of the loans in the $1.2 trillion institutional leveraged loan market. While banks of course hold additional loans outside the institutional market, including revolving credit lines, the possibility of leveraged loans as a driver of systemic risk at banks seems farfetched.

[4] Statista