July 13, 2017 - It may be shaping up to be a rather strong year for CLOs. After a dismal January, U.S. CLO formation moved at a solid clip in first and early second quarter. Then, in June, the pace accelerated to a sprint. While it’s not clear this pace will continue, CLO analysts have ratcheted up their 2017 issuance forecasts. We discuss these trends – and their facilitators – below.

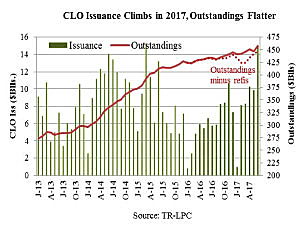

U.S. CLO issuance approached $15 billion in June, the highest post-crisis monthly volume since March 2015, bringing 1H17 CLO formation to $52 billion, according to TR-LPC’s Leveraged Loan Monthly. (As of Wednesday afternoon, July had brought another $1.75 billion of issuance, S&P/LCD reported.) However, similar to the trend in the loan market, growth in CLO outstandings has lagged new issue. This is demonstrated in the LSTA Chart of the Week,  which compares new CLO issuance (green bars) to CLO outstandings (red line) and CLO outstandings less refis (dotted red line). The point being is that while CLO issuance was $52 billion, CLO outstandings have grown by a less impressive $12.8 billion. And if one removes refis – which, having lower spreads and shorter maturities, may not meet the needs of original investors – CLO outstandings are up just $6.5 billion from year end.

which compares new CLO issuance (green bars) to CLO outstandings (red line) and CLO outstandings less refis (dotted red line). The point being is that while CLO issuance was $52 billion, CLO outstandings have grown by a less impressive $12.8 billion. And if one removes refis – which, having lower spreads and shorter maturities, may not meet the needs of original investors – CLO outstandings are up just $6.5 billion from year end.

Why is this important? Because like everyone else in a yield- and product-starved world, CLO investors are seeking assets. In turn, as CLO outstandings increase only modestly, CLO investors increasingly are willing to accept lower spreads. To that end, at an average of LIB+125 (and a low of LIB+118), new issue CLO AAA spreads are down more than 30 bps from this time last year. Meanwhile, Deutsche Bank notes that CLO AA, A and BBB note spreads are near their post-Crisis tights.

Of course, while CLO note spreads have compressed, loan spreads have fallen much faster – and this continues to squeeze the asset-liability arbitrage. In theory, this should slow CLO formation. In reality, the combination of lower CLO note spreads and a longer reinvestment period can keep issuance going. As Deutsche Bank notes, the fact that reinvestment periods are extending to five years (while the non-call period remains at two years) means that many new CLOs now have a three-year “optionality” period when the equity can reprice/reset the deal if CLO note spreads compress further. This comforts equity investors and supports continued deal-doing.

So, in light of these trends, where will CLO issuance end the year? CLO analysts have been moving their estimates up. Wells currently sits at $75 billion, Morgan Stanley at $80 billion, Nomura at $85 billion, BAML at $90 billion and Deutsche at $95 billion of new issue. However – like the chart suggests – observers note that repayments are likely to be material and CLO outstandings may grow only $20-25 billion this year.