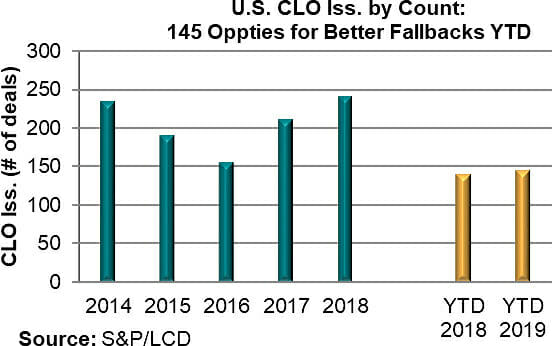

August 2, 2019 - According to LCD, and illustrated in the COW, there have been at least 145 U.S. CLOs issued thus far in 2019. That represents 145 opportunities to put in stronger, more robust, more workable LIBOR fallback language into CLOs. While most 2019 CLOs used “amendment” fallback language – which might be challenging to execute en masse when LIBOR ends – we were gratified to hear that several recent CLOs included more robust hardwired fallback language. Below, we discuss why good fallbacks are critical and highlight a recent CLO that used more robust, more-ARRC-able fallback language. (To wit, as Covenant Review noted, “attributes [of hardwired fallbacks] will be important for a smooth transition from LIBOR to SOFR and will reduce litigation risk for all parties.”

Why do we care about fallbacks? Because LIBOR almost definitely ends sometime – and possibly shortly – after year-end 2021. Andrew Bailey, the CEO of the U.K. Financial Conduct Authority recently stated the base case assumption should be “no LIBOR publication after end-2021.” Ignoring this benefits no one.

What is fallback language? It describes how a CLO would fall back to a new rate upon the cessation of LIBOR. Until recently, CLOs have not used standardized language, but primarily relied on some form of amendment to move to a replacement rate. While this sounds more flexible, it may not be realistic to assume that all CLOs could easily transition when LIBOR actually ceases. In contrast, “hardwired” fallback language dictates that, were LIBOR to cease, CLO liabilities would first fall back to Forward Looking Term SOFR plus a spread adjustment, and if that did not exist, then Compounded SOFR plus a spread adjustment. There are additional levels of the “fallback waterfall” in the ARRC securitization fallback language, but – and here’s the critical point – Compounded SOFR exists today and ISDA will publish the spread adjustment around year-end 2019. Thus, it is extraordinarily likely that Stage Two of the hardwired waterfall will exist at LIBOR cessation. Moreover, as we discuss in this post, if both CLOs and loans adopt the hardwired approach, both transition risk and basis risk for the equity will be reduced.

What’s going on with the hardwired approach? We have heard rumors of at least five CLOs that have used hardwired fallback language, and one – HPS Loan Management 15-2019– recently entered the public domain. Even better, Covenant Review analyzed it! We flag several key issues from their synopsis here, but also recommend that interested readers visit Covenant Review for all the details. First, the triggers: The HPS CLO converts to a replacement rate upon the cessation of LIBOR or a regulatory announcement that LIBOR is no longer representative. Next, the waterfall: The ARRC recommended hardwired language includes five steps in the waterfall, whereas the HPS language is a bit more truncated. According to Covenant Review, the HPS waterfall is: 1) Term SOFR, 2) Compounded SOFR, 3) rate recommended by ARRC, or, if all of these fail, an amendment by the majority of the controlling class and subordinated notes to provide for a new rate. The spread adjustment is that which is recommended by the ARRC, but does not include an ISDA spread adjustment. (The ARRC has said it is very open to recommending a cash spread adjustment; there is a non-trivial probability it will be identical to or reference the ISDA spread adjustment.) Third, the takeaway: Inasmuch as Compounded SOFR exists today and ISDA will be publishing a spread adjustment around the end of this year (and assuming the ARRC blesses it), hopefully the HPS hardwired fallback language would not go past Stage Two of the waterfall. That means the HPS CLO should nearly automatically convert to a replacement rate – and reduce the risk of attempting an amendment at the same there is a rush for amendments – upon the cessation of LIBOR. And, in our humble opinion, reducing transition and systemic risk is a good thing!