May 30, 2019 - In a recent LIBOR Roundtable co-hosted with Cadwalader, we discussed six steps to leaving your LIBOR. Step 3 is “Know Your Potential Replacement Rates”. The reality is that SOFR, the Secured Overnight Financing Rate, will be the fallback for U.S. dollar derivatives and likely will be the fallback for cash products. Thus, lenders are keenly interested in seeing what the rate looks like. Below we first define the potential SOFRs and then chart the SOFRs to demonstrate their characteristics. (We hope readers are as excited as we are to really finally see how SOFR behaves!)

While derivatives will be using “SOFR Compounded in Arrears”, there are four potential SOFRs that cash products may use:

- Forward Looking Term SOFR. This rate would be most analogous to LIBOR in that it would have a term curve and likely be quoted as 1-month, 3-month and 6-month SOFR. It would be easy to operationalize in loan systems and would require few changes to conventions. The negative is SOFR is actually a daily rate and a Forward Looking Term SOFR would have to be extrapolated from SOFR futures trading. Though an indicative Forward Looking Term SOFR exists today, there is no guarantee that an IOSCO compliant Forward Looking Term SOFR reference rate can be created. Moreover, if lenders simply wait for Forward Looking Term SOFR to exist, the necessary overnight SOFR futures trading won’t occur and a forward looking reference rate won’t develop. Classic chicken-and-egg problem.

- SOFR Compounded in Advance. This is the rate that would be compounded over the previous 30/60/90 days. The positives are that the rate would be known in advance and could be operationalized easily. The potential negative is that it could be perceived as being stale.

- SOFR Compounded in Arrears. This rate would be compounded during the life of the loan contract. The positives are that it is the exact real interest rate for the contract period and it’s perfectly hedgeable with swaps. The negatives are that the final rate would not be known at the start of the interest period – though the accrued rate would be known at any point in the period – and it is complex to operationalize.

- Simple Daily SOFR in Arrears. This is the simple – not compounded – rate that accrues during the interest period. The positives are that it is the exact real interest rate for the contract period, it’s close to hedgeable with swaps and can be operationalized fairly easily. The negative is that the rate would not be known at the start of the interest period.

But enough about what these rates are…how do they look and feel? The Federal Reserve has quietly begun to publish an Indicative Forward Looking Term SOFR and Compounded SOFR on its website. To be clear, the indicative rates are only that; they are not to be used in contracts. So how do they look?

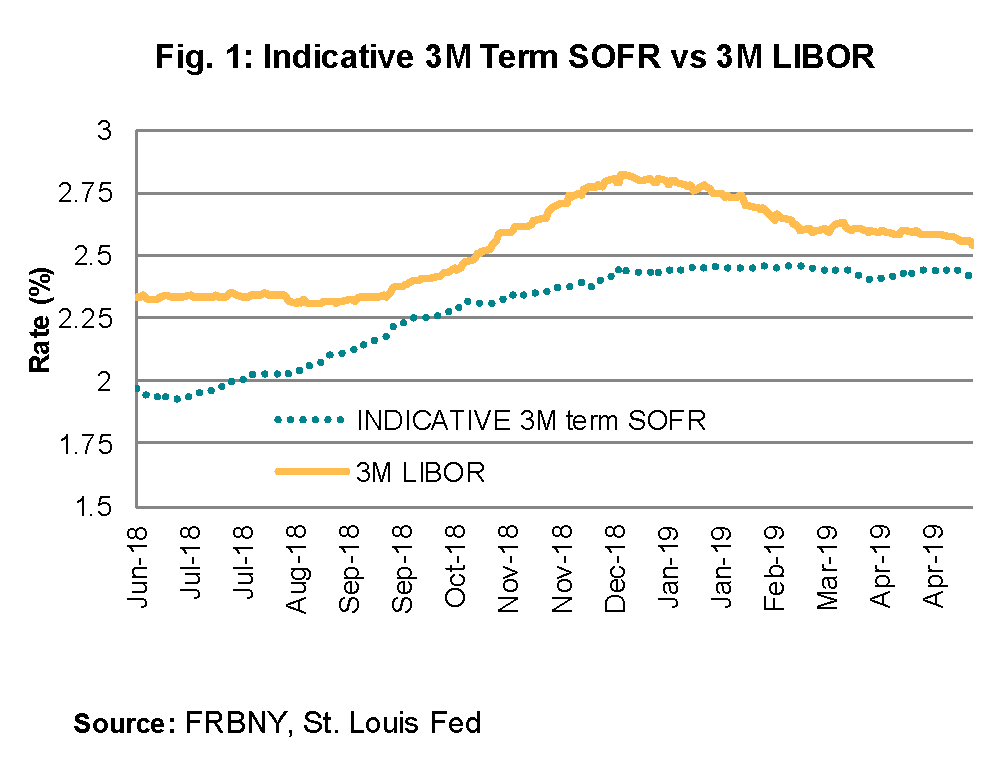

As Figure 1 demonstrates, as expected, the indicative 3-month Forward Looking Term SOFR is lower than 3-month LIBOR. (This is because SOFR is a risk-free rate, while LIBOR includes a bank credit risk component.) For loans that fall back from LIBOR to SOFR, the plan is to include a “spread adjustment” to make SOFR more comparable to LIBOR. The ARRC hardwired loan fallback language first recommends an ARRC-endorsed spread adjustment for cash products. If that doesn’t exist, the fallback language next recommends the ISDA spread adjustment for derivatives. While it’s not completely final, ISDA’s consultation results strongly suggest they would take a historical mean or median of the difference between LIBOR and SOFR to create the spread adjustment. The mean and median differences in Figure 1 are 26 and 25 bps, respectively.

While many lenders want a forward looking term SOFR, it is possible that there simply will not be enough SOFR futures trading to create a robust IOSCO compliant reference rate. For this reason, we need to plan for the possibility of using compounded rates. So what do they look like?

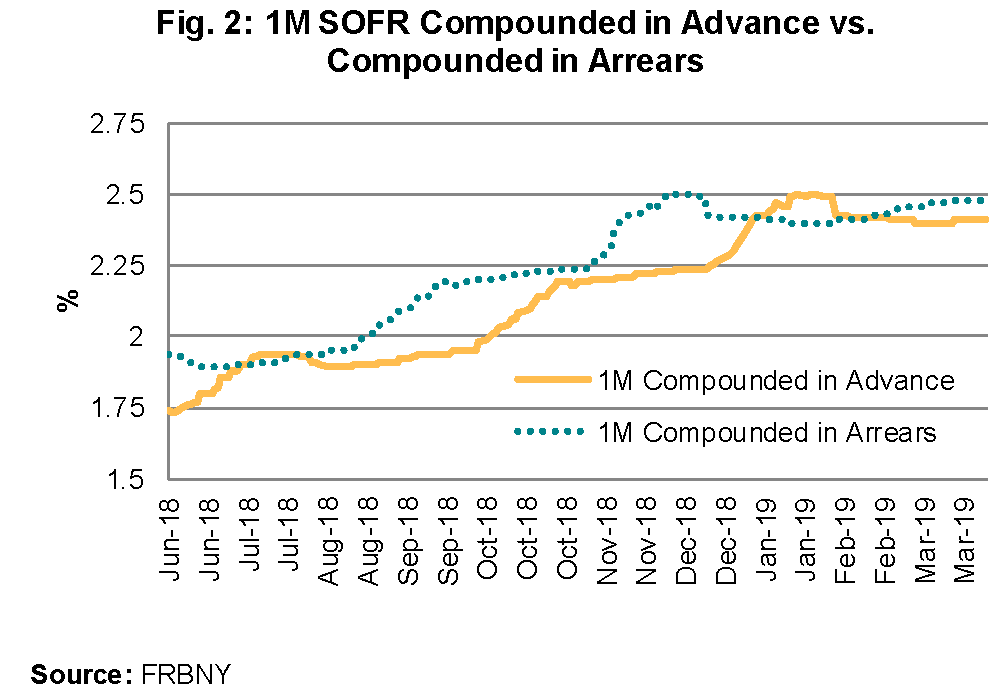

In Figure 2, we compare the 1-month SOFR Compounded in Advance rate to the 1-month SOFR Compounded in Arrears rate. As one can quickly discern, these are exactly the same rates; the only difference is that the Compounded in Arrears rate (which is compounded during the life of the loan contract) predates the Compounded in Advance rate by one month. There has been some concern that SOFR Compounded in Advance might be stale in periods of rapidly changing rates or for particularly long contracts. This potential delay should be weighed against the fact that SOFR Compounded in Advance can be operationalized more easily.

Next we compare the look and feel of Forward Looking 1-month SOFR against 1-month SOFR Compounded in Arrears. As Figure 3 illustrates, these rates are very similar. In fact, this should not be a surprise. After all, Forward Looking Term SOFR is the expectation of where interest rates should be, while SOFR Compounded in Arrears is simply where interest rates are. Unless there is an unexpected rate change or a period of unexpected volatility, the rates should be fairly similar. One of the reasons some lenders have been uncomfortable with SOFR Compounded in Arrears is that they would not know the exact rate they would receive and the borrower would pay. While it may not be possible to have a Forward Looking Term SOFR reference rate, it should be possible to see the indicative forward looking rate. While there would still be operational challenges around SOFR Compounded in Arrears, the lack of visibility into the ultimate rate probably should not be a stumbling block.

The LSTA is a member of the Alternative Reference Rates Committee (ARRC), co-chairs the ARRC’s Business Loans Working Group (BLWG) and has spun out a BLWG Operations Group. For more information, please contact mcoffey@lsta.org (policy and market analysis), ehefferan@lsta.og (operations) or tvirmani@lsta.org(legal and fallbacks).