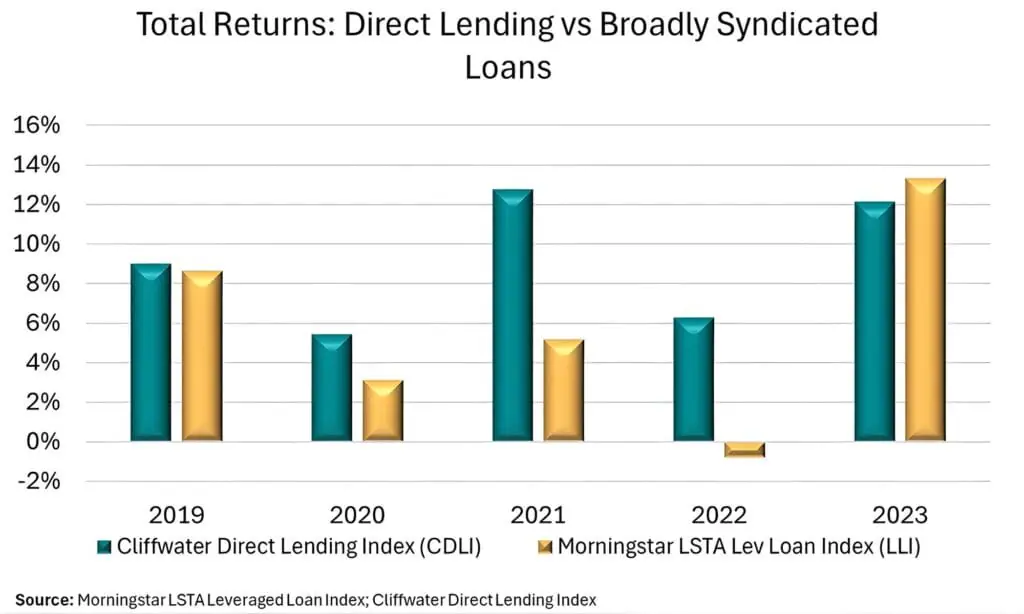

May 1, 2024 - Returns for direct lending loans jumped to 12.13% in 2023, from 6.29% in 2022, according to the Cliffwater Direct Lending Index (CDLI). CDLI returns were the highest in two years, but below the 12.78% return in 2021, when performance was driven by a sharp rebound in loan valuations from the pandemic that propelled CDLI fair value marks 324 basis points higher. Fourth quarter returns came in at 2.95% compared to 3.17% in the third quarter, the highest since 1Q21.

Performance trailed the extraordinary return of 13.32% in broadly syndicated leveraged loans (BSL), as per the Morningstar LSTA Leveraged Loan Index (LLI). But in line with the asset class’s strong risk-adjusted performance, last year and 2009 represent the only years BSL returns outpaced direct lending. In both instances, BSL levels were rebounding from negative returns in prior years: during the Global Financial Crisis of 2008 and in 2022 when the Federal Reserve quickly raised rates to contain inflation. In contrast to BSL, direct lending loans are held across a small group of lenders generally pricing at a premium to broadly syndicated loans to account for certainty of execution and held to maturity underwriting strategies. The CDLI index currently tracks about 14,800 directly originated loans held by Business Development Companies (BDCs), as compared with 14,000 loans as of 3Q23. Index assets have spiked $315 billion as of 4Q2023, up from $295 billion in 3Q23 and from $130 billion in 2020.

Delving deeper into 2023 performance, 12.08% of total return was driven by income from higher interest rates. Three-month SOFR, the most common reference rate in direct lending loans, jumped to over 5%. Since the index’s inception in 2004, annual interest income has averaged 10.81%.

Beyond the jolt from higher interest rates, net unrealized gains in the CDLI nudged 0.92% higher in 2023, representing upside changes to the quarterly valuations in portfolio loans. We can observe this in the weighted average fair value of senior direct lending loans: These ticked higher last year with little volatility to end the year at 98.99. It is worth highlighting that those senior loans made up 81% of the index as of December 2023, as the market migrated away from subordinated to senior debt over the last 13 years.

While higher interest rates boosted returns, higher interest payments from borrowers brought credit fundamentals into focus. Although the index’s share of non-accrual loans remained contained last year at 1.54%, there are signs of increasing stress. Realized losses, or principal write downs generally from borrower defaults were 0.08% in 4Q and 0.86% for FY2023, below the 10-year average of 0.96% but the highest since 2020. And this week, JP Morgan commented it expects distressed opportunities to increase within private credit, noting that although leverage has declined, the high cost of debt has resulted in lower interest coverage ratios

Based on a curated list of 2,400 borrowers financed by direct lending, the KBRA DLD Index recorded a default rate of 2.3% in 2023 (based on issuer count) with sponsored loans faring better (1.8%) compared to non-sponsored loans (3.7%). All told, 55 issuers defaulted last year and KBRA DLD forecasts 2024 default volume to tick higher to include 69 borrowers for a default rate of 2.75%. Again, sponsored direct lending loans are expected to hold up better (2.5%). On the BSL side, defaults ended 2023 at 3.38% (by volume) and are expected to end the year higher, per Fitch Ratings.