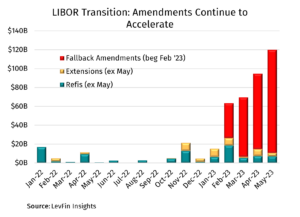

June 1, 2023 - After six long years the end is in sight! Admittedly, it may not feel that way now as members continue to plow through remediation amendments and are on track to double efforts this month. Headway is being made however – major headway. Nearly $110 billion dollars in fallback amendment activity was tracked by LevFin Insights, with a further $10 billion transitioning to SOFR via other means. Still there is significant wood to chop. We expect that around half of all outstanding institutional term loans remain tied to LIBOR so the loan market needs to keep up this momentum. It is also important to remember that of those outstanding LIBOR loans, over 35% include hardwired fallback language according to Covenant Review. Furthermore, only about 8% of loans in the CS LLI have no structured fallback language. Not a trivial amount, but also a significant minority. Also, borrowers who face Prime have some options available to them while they remediate their loan (through refinancing or consensual amendment). Some borrowers may choose to elect a longer tenored LIBOR rate at their next reset date. For instance, if a borrower elected 6-month USD LIBOR today, the next interest reset would not occur until December. Also, we know that certain credit agreements are drafted such that the terms of the agreement will look to synthetic USD LIBOR. Furthermore, while June 30th looms large (in flashing lights!), the impact may feel less like turning off a LIBOR light switch. In practice, the credit agreement transitions before a new SOFR rate is relevant for interest resets. Remember, where interest is set on June 30th (or the following few days depending on lookback length), the relevant LIBOR tenor setting would apply. That rate will continue to be the relevant rate for the credit agreement through that interest period.

Bottom line: Keep up the good work – the end is in sight. Here’s to a boring, uneventful transition!