October 5, 2020 - LIBOR cessation is coming…and (some) CLOs have a problem. While LIBOR cessation may be operationally challenging for products that have workable fallback language, it is highly problematic for products with either no fallbacks or totally inadequate fallback language. We discuss the problem – and potential solutions – below.

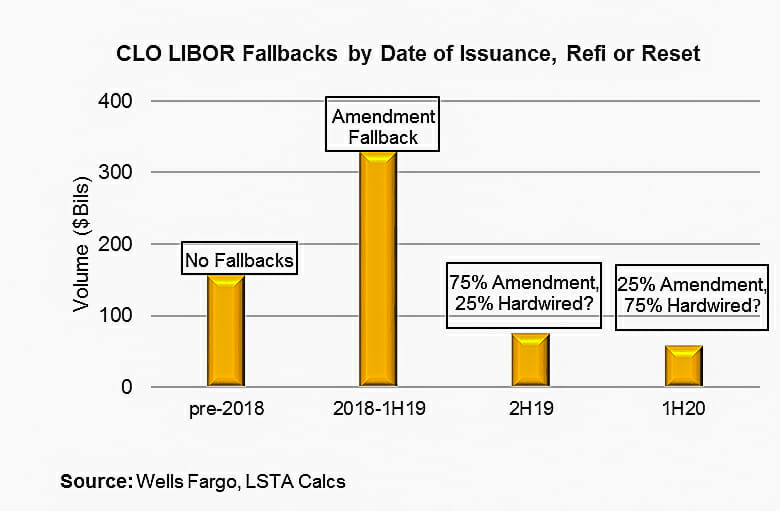

Because market practitioners only became aware of LIBOR cessation in late 2017, CLOs issued prior to 2018 generally have inadequate fallback language. If LIBOR is not published, most of the notes in these CLOs would reference last quoted LIBOR. In effect, this would convert floating rate liabilities into fixed rate liabilities, which is not what anyone expected when they invested in the CLO notes. In fact, this is not a tiny problem. According to data from Wells Fargo, over $150 billion of CLOs were issued or last refinanced or reset prior to 2018 (See COW). These are the CLOs that might see their liabilities flip from floating to fixed rate.

There are several avenues to fix this. First, the CLOs themselves may be refinanced, reset or called. Second, the ARRC is engaging with the New York State Legislature to create a fix for contracts that either are silent if LIBOR ceased or that would end using the last quoted LIBOR. In these cases, the ARRC has recommended a narrow legislative fix that would allow these contracts to use the ARRC fallback language.

Of course, there’s no guarantee that the NYS legislation will pass prior to LIBOR cessation; amending those pre-2018 CLOs to add fallback language may be a more certain solution. And so, U.S. CLO market participants asked the LSTA to help create standard forms for such amendments, including draft operative LIBOR replacement provisions, template language for a modification of the indenture and sample exculpation clauses for trustees and managers.

The purpose of the operative Libor replacement provisions and accompanying form of supplemental indenture is to provide a template for CLO investors and transaction parties to use in connection with a CLO transaction that does not already contain provisions to effect the transition or fallback from LIBOR to a non-LIBOR benchmark rate upon the occurrence of certain Libor transition events. The form of supplemental indenture assumes that the applicable CLO Indenture: (i) would require the consent of the holders of each class of notes to adopt a benchmark replacement rate to Libor and (ii) has no fallback or amendment language that would permit the adoption of a benchmark replacement rate without the consent of certain holders, other than a fallback to “fixed” LIBOR.

LSTA members believed that having a standard set of provisions may help facilitate the execution of such an amendment. The document was developed with a working group of CLO market participants and was then vetted by the LSTA CLO Committee. Here is the Exposure Draft of the LSTA’s LIBOR Replacement Provisions for Amendment of CLO Indenture. We plan to publish it in final form in early November.