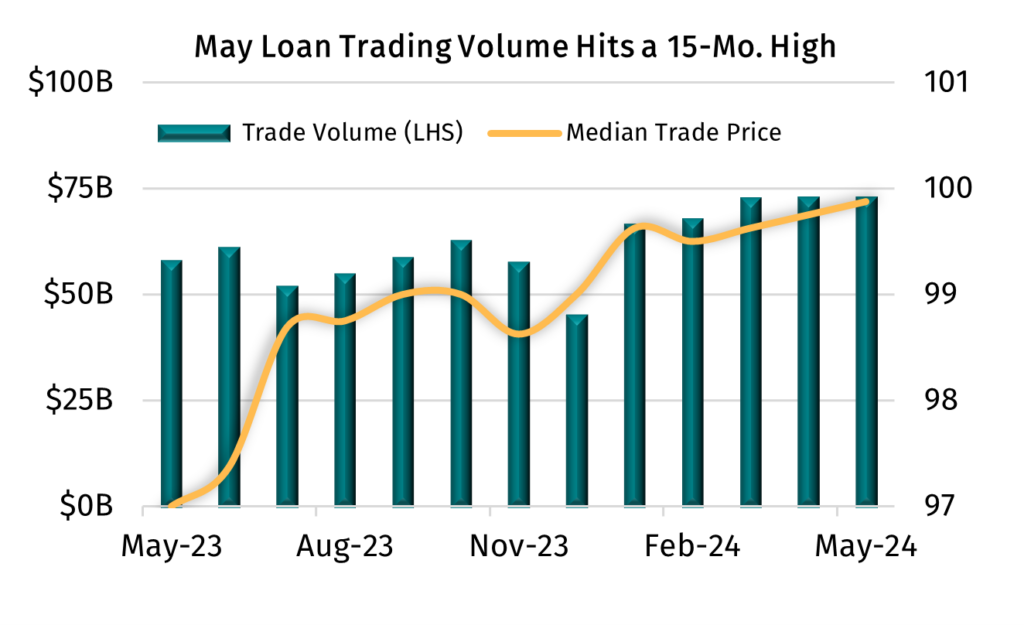

June 20, 2024 - LSTA secondary loan trading volume remained elevated yet again in May, at a 15-month best $72.5 billion. May marked the third consecutive month where volumes ran north of $72 billion – a feat not seen since early 2022. And while secondary activity stood unchanged in May, a record $180 billion of institutional loans priced in the primary, with repricing activity representing two-thirds of total deal flow. Speaking of records, secondary volumes are trending towards all time-highs. While a bit overzealous to annualize data after just five months, 2024 volumes (when annualized) are tracking to $841 billion and would surpass 2022’s record of $824 billion. Better still, year-to-date secondary volume is up more than 7% over the same period last year while the number of individual loans trading on a per-month basis has increased 5% in 2024, to an average of 1,570 loans.

Over to the markets where equities and fixed income rallied in May and technical conditions in the loan market favored sellers over buyers once more. In turn, the median secondary trade price edged closer to par after rising an eighth of a point to 99.875 (matching the market’s previous high-water mark of January 2022). At the same time, the median “mark-to-market” bid-ask spread on the traded universe of loans remained rangebound in a low 50 basis point context. But as we mentioned last month in this space, today’s secondary is comprised of a series of haves and have-nots.

While today’s market remains historically frothy, with 50% of secondary activity transacting above par, there was a sizeable increase in trade activity on the stressed side of the market too. Loans trading in a sub-90 context garnered a six-month high 16% share of May trading volume. Interestingly, the increase in stressed loan activity coincided with a bearish move in the number of credit downgrades relative to upgrades. According to the LLI, the 3-month rolling ratio of downgrades to upgrades widened to 2.2:1 in May, after tightening to 1.6:1 back in March. That said, the default rate (including distressed exchanges) has sat in a 4.3% range over the past three months while the LLI’s distressed ratio (the percentage of loan outstandings priced below 80) remains very manageable at just 4.5%.