January 9, 2024 - Loans returned 13.32% in 2023, the best performance since the Global Financial Crisis and the second highest annual return since the Morningstar/LSTA Leverage Loan Index (LLI) was introduced in 1997. Returns were positive in nine out of 12 months last year, bookended by a return of 1.65% in December and 2.89% across the last two months of the year, as risk assets rallied on the expectation the Fed would soon begin to cut interest rates. High-yield bond prices jumped 6.6 points in the last two months of the year, pushing annual returns to 13.45%, per Bloomberg Indices. The outperformance relative to loans is notable given the high-yield asset class trailed loans for most of the year. Investment-grade bonds also rallied in the final months of the year to end the year at 8.52%, while the S&P 500 was up 4.54% in December to end 2023 up 24.23%.

Robust economic growth combined with lower inflation assuaged credit concerns and underlined performance across markets last year. For loans, higher base rates propelled the asset class’s share of income return to 9.54% – the highest levels on record – for over 70% share of annual total return. But loans also traded higher. The average price of the LLI ended the year up 379 basis points for a market value return of 3.46%. However, market value gains were lower compared to other years that closed with loan returns in the double digits.

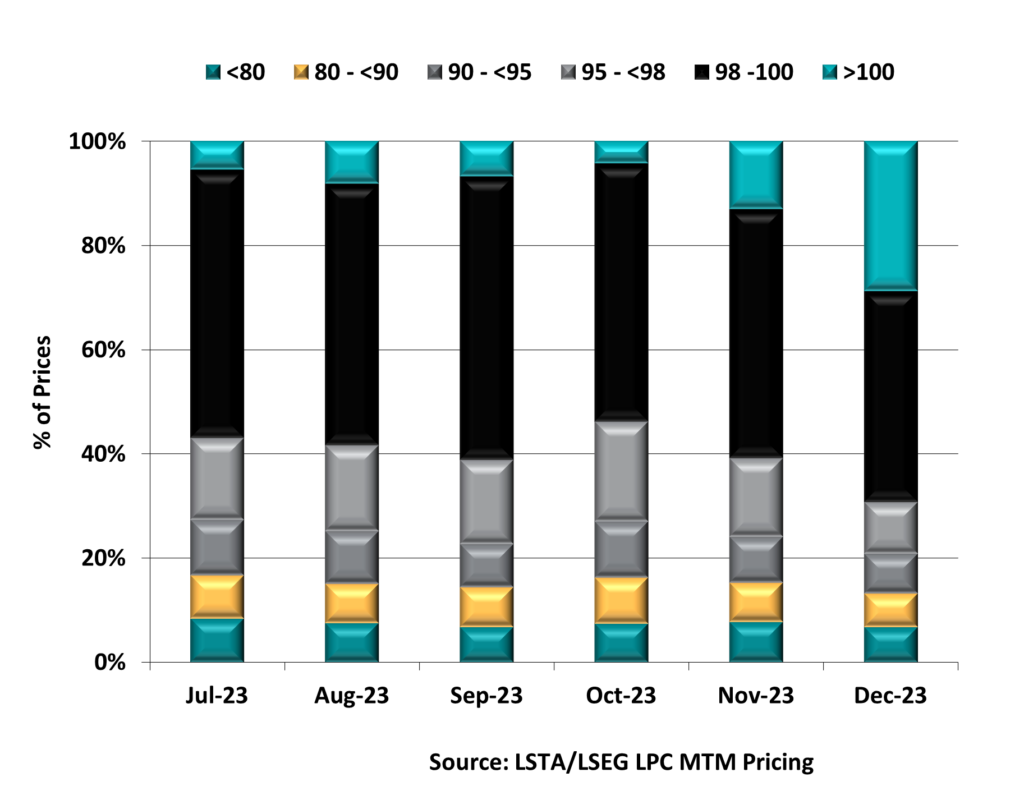

The index’s average price advanced across every trading session in December, ending the month up 93 basis points to 96.23, the highest level since 2Q22. Advancers led decliners by a rate of 8.2:1 in the month, sending the share of the secondary market above par to 29%, from 3% at the beginning of the year, with 69% bid at 98 or higher. As was the case for most of the year, the riskiest loans outperformed in December. B rated loans were 1.79% higher, compared to 1.23% for BBs, while CCCs jumped 2.7% in the month to end 2023 with a 14.54% return, bouncing back from the sharp losses (-12.24%) recorded in 2022.

The buoyant secondary was an opportunity for lenders to tap the market for liquidity. According to Pitchbook LCD, just under $20B of repricings hit the institutional market in December, complemented by $13.9B of refinancings and extensions. Combined, repricings and refinancings made up the bulk of activity in the month and year. Institutional M&A related activity made up a meager 29% share of lending this year, the lowest since 2010, with higher cost of funding and market uncertainty impediments to dealmaking.

After expanding 21% between 2020 and 2022, index outstandings declined 1.13% last year. Competition from private credit grabbed most headlines and Pitchbook LCD tracked $16B of institutional loans that exited the broadly syndicated market via direct lending. However, over $28B of institutional loans were also replaced by HY bonds.

New loan supply was insufficient to meet demand for loans. CLO volume, the biggest source of demand for loans, fell 12% YoY to $116.4B but included $28B in private credit/middle market CLOs for a 24% share, the highest on record. Net of CLO calls, run offs and repayments, the CLO market grew $49B, the lowest in six years, per Morgan Stanley calculations, as a shifting investor base, challenging arbitrage and lower loan supply impacted flow. Market observers are pointing to roughly the same levels of issuance in 2024 with private credit expected to grab an even bigger share.

On the retail side of the market, the large outflows witnessed when the Fed started raising rates ebbed in the second half of 2023, leading to modest inflows in three of the last six months of the year. For the full year, loan mutual funds and ETFs shed $17.5B, per LSEG Lipper. Together, CLOs and loan funds registered $99B in visible demand, lower from the previous year but nonetheless a wider technical imbalance given the scant supply, sending investors to the secondary market to source assets, driving up prices.

While the macro environment and the absence of a much-anticipated recession was overall favorable to loans, the highest interest rates in over 20 years did introduce stress to borrower balance sheets and drive credit rating downgrades. The CCC share of the LLI increased by $23.8B last year to 8.3%, up from 6.6% a year earlier. Similarly, the share of loans rated at B- stands at 22.7% – near the record high reached earlier in 2023 after climbing 17% over the last 5 years. Beyond downgrades, the trailing 12-month loan default rate increased from 1.6% a year ago to 3.04% at year-end 2023, per Fitch. The rating agency is forecasting 2024 default rates to increase to the 3.5%-4% range as the impact from interest rates will add to the economic headwinds facing borrowers.