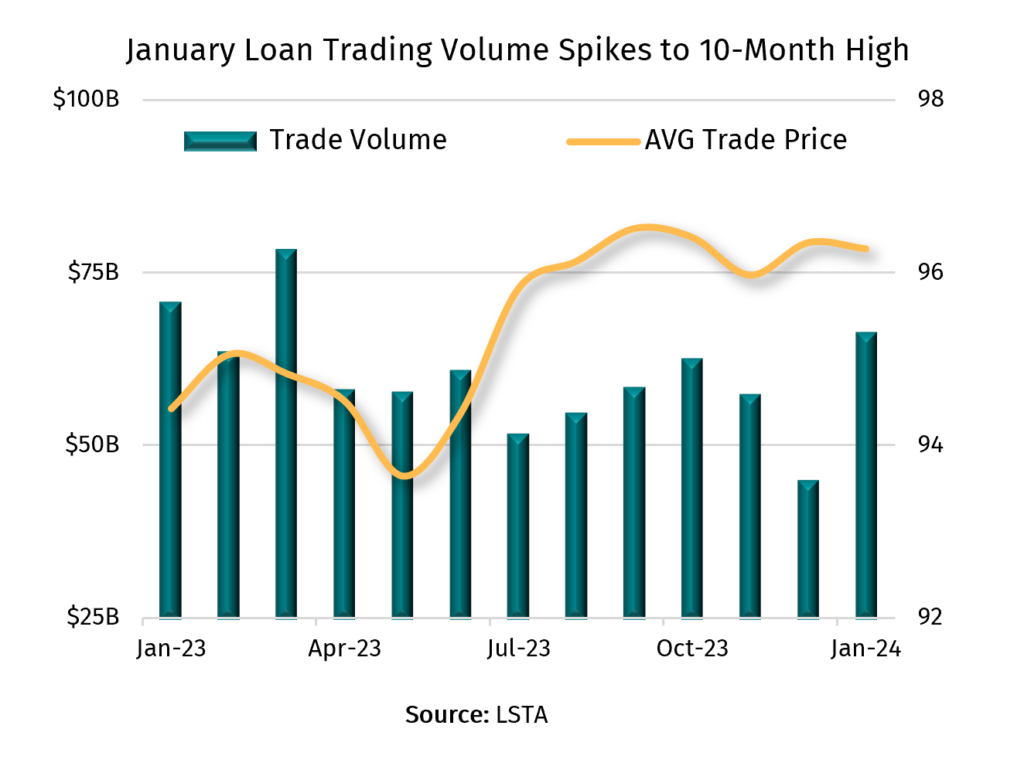

February 22, 2024 - LSTA secondary loan trading volume increased a massive 48% in January (over December) to a 10-month high of $66 billion. But of course, the month of December was once again a very easy comp to beat at just $45 billion. Conversely, a year-over-year comparison revealed a decline of 6% in trade activity. Even still, January marked the first time since March 2023 that volumes ran north of $65B. Better yet, January’s total was 18% higher than the monthly average volume reported since April of last year. And as volumes trended higher to begin 2024, monthly market breadth improved as more than 1,550 distinct loans traded in January, marking just the second time that figure exceeded1,500 since the end of 1Q23.

So what drove secondary activity higher in January? Well, there are several noteworthy storylines to consider alongside our trading stats. First, after two months of strong gains in the secondary, a bit of volatility returned to the loan market, particularly during the latter half of January. In turn, trade levels fell from their mid-January highs with the Morningstar/LSTA Leveraged Loan Index (LLI) reporting its first monthly market-value loss (0.12%) since October – even as total return remained positive at 0.68%. In total, trade prices fell just seven basis points across January to 96.27, while LSTA/Refinitiv MTM bid-ask spreads, on the traded universe of loans, tightened slightly from 78 to 74 bps. Interestingly though, as the average price fell slightly, the cohort of loans trading above 98 represented a 70% share of total volume, up six percentage points from December. Secondly, visible demand levels surged as CLOs reported their busiest January ever at $12.5 billion and loan mutual funds and ETFs reported more than $500 million inflows. Lastly, the primary market unleashed a near-record wave of refinancing and re-repricing activity, which, as expected, drove relative value trading higher. But that said, net new money volume remained low while repayment rates stayed elevated, which drove the size of the LLILLI lower for the fourth month in a row – shrinking the size of the tradable universe of loans yet again.

In conclusion, as one buyside trader put it, “Without a dynamic net-new issue market, I remain an active buyer in the secondary, but rarely an active seller, and until these dynamics change, we should not expect to see the level of trading activity that we saw across 2022 and early 2023.”