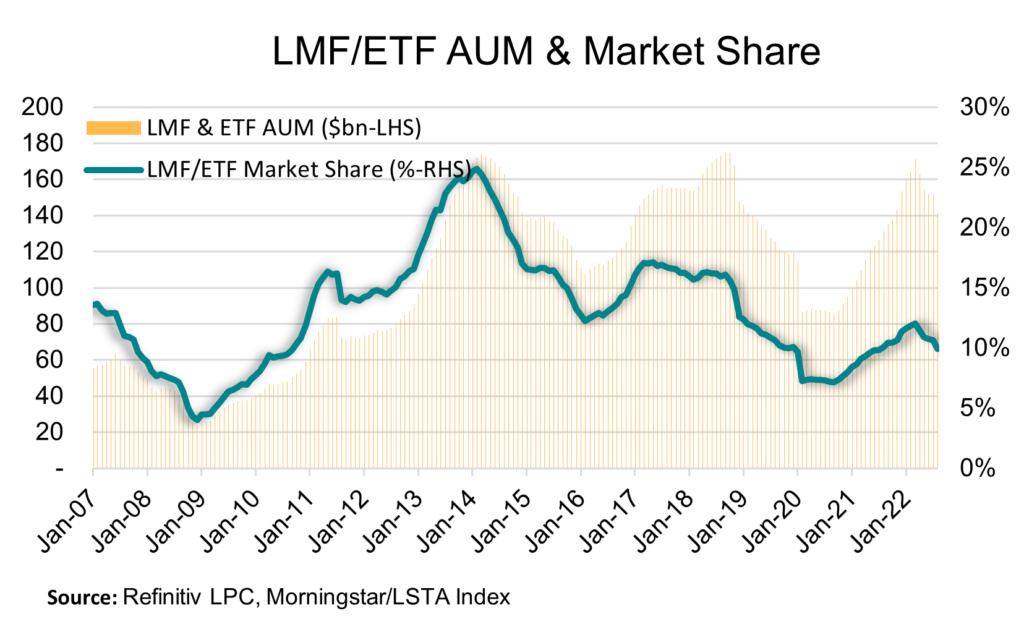

November 4, 2022 - As discussed previously, the SEC Wednesday released a proposed rule on Open-End Fund Liquidity Risk Management Programs and Swing Pricing. While we will be dissecting the proposed rule for weeks to come, it may be useful to begin sizing the open end loan mutual fund (LMF) and ETF market, which would be materially impacted in any final rule. As the COW illustrates, the size and market share of loan mutual funds and ETFs has waxed and waned over time, ranging from less than $30 billion and 4% of the market in late 2008 to more than $170 billion and 25% of the market in 2014. There are two main drivers to changes in the size of LMF AUM: 1) Inflows or outflows and 2) loan prices, which affect the value of the assets themselves. Typically, LMFs see inflows in rising rate environments because they earn more interest and – unlike fixed rate securities – they maintain their value as interest rates rise.

2022 has turned that relationship on its head. Interest rates are rising, which should make floating rate products attractive. However, geopolitical stress, inflation, recession concerns and a general risk-off mentality has hit many asset classes, including loans. As the COW intimates, LCD reports and Refinitiv Lipper charts in their Leveraged Loan Monthly, the first nine months of the year saw five consecutive outflows (from May to September) from LMFs, totaling $24 billion. Meanwhile, the average loan price in the Morningstar/LSTA Leveraged Loan Index dropped from 99 in late January to 92.5 this week. LMFs strike an NAV daily, so the decline in prices also impacts their asset value. Between the outflows and the decline in loan prices, LMF AUM dropped roughly $30 billion between April and September.

So what is likely to happen with LMF AUM in the coming months. While a bit dated, Pitchbook LCD’s third quarter survey provides some views into sentiment. First, when asked whether the Morningstar/LSTA Loan Index has hit the lows of the credit cycle, 38% of respondents said “yes” and 62% said “no”. Assuming this is not a contrarian indicator, the responses suggest that the asset value side of LMF AUM might slide a bit further. Second, when asked about expectations for LMF flows, the views were more positive (or less negative). Just 18% said outflows would accelerate, 42% said outflows would moderate, 11% said they would be neutral (neither inflows nor outflows), 24% said moderate inflows will return and 4% said inflows would be significant.

So what has happened since then? In October, loan index returns were positive, hitting 1.03%, according to LCD. Meanwhile, loan outflows have moderated – a bit. Morningstar reported weekly outflows of $725 million the week ending October 26th, down from more than $1 billion each week since mid-September.