December 5, 2023 - Markets rallied in November, driven by a better-than-expected inflation reading that fueled investors’ expectations for no further rate hikes from the Fed, a sentiment reinforced by comments from several FOMC members. The optimism sent the S&P 500 8.9% higher, marking the index’s best performance since the sharp rebound from the pandemic sell-off in 2020. Returns on U.S. HY bonds jumped to 4.53% in the month, while U.S. IG bonds were higher still at 5.98%, according to Bloomberg Indices. Closer to home, leveraged loans returned 1.22% for their best performance since July, according to the Morningstar/LSTA Leveraged Loan Index (LLI). But YTD, loan performance has been more consistent, posting positive returns in eight of the past 11 months. At 11.48%, loan YTD returns trail only US equities (19%).

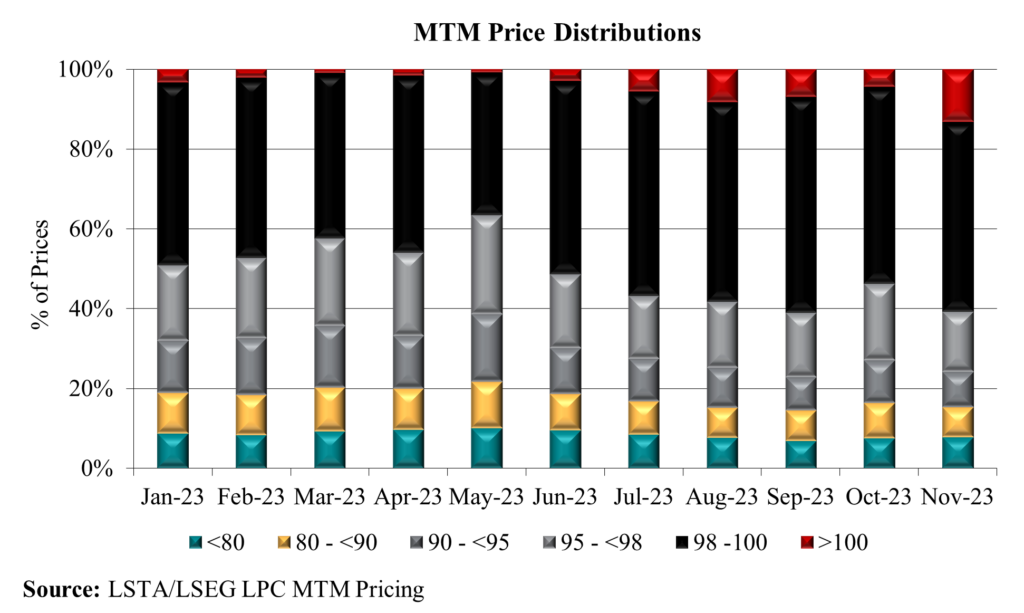

Even by the standards of a post-Covid environment, the movements across markets were exceptional. The average bid across U.S. HY and IG bonds jumped two points in the first week of November, driven by the conviction that duration risk was dissipating. Of course, leveraged loans have been a beneficiary of higher base rates and November was no exception. Interest income added 0.78% to 0.44% in market value gains. YTD, interest rates have comprised roughly three-fourths of total return, but a richer secondary added 2.59% of return, in contrast to declining valuations last year. In November, the average loan price advanced 53 basis points to 95.29, up 285 basis points over the same period last year. Higher market values sent the share of loans priced at or above par to 13%, the highest level in two years, as 72% of loans ended the month with higher prices. Within this cohort, over half (54%) of loans advanced by less than 1%, while a sizable minority (22%) increased between 1% and 5%. Delving deeper, we observe that gains did not extend to the riskiest segments of the market, with the average price on CCC rated loans flat in November at 79.18 while B- and B rated loans were 60 basis points higher as investors focused on credit quality amid the rally.

The bullishness also served to push visible demand to the highest level this year leading to a widening technical imbalance. Starting with CLOs, the biggest buyers of leveraged loans, issuance in November jumped to $15.1B, the strongest in nine months. Broadly syndicated loan (BSL) CLOs added $10.8B with private credit CLO issuance increasing to $4.3B, the highest level this year and 28% of monthly activity, underlining the robust demand for private credit. Including $907M of inflows to loan mutual funds and ETFs, per Lipper, visible demand jumped to over $20B, double the average this year.

On the supply side, as has been the case for most of this year, the strong market conditions drove opportunistic refinancings, which do not increase net new loan supply. According to Pitchbook LCD, institutional lending inched ahead in November, but institutional loan M&A and LBO lending remains elusive and down 52% YoY because of wide bid-ask spreads in dealmaking. LLI outstandings declined $4B to end November at $1.4T. The statistic was also hampered by the encroachment of private credit in the BSL market, headlined in November by Adevinta ASA’s €4.5B unitranche (the largest to date in the European market). The loan which will replace the borrower’s euro and U.S. dollar denominated syndicated loans.